I’ve been trading for 7 years, beginning with the most volatile market—crypto. My formal trading education started with Forex. This was back when crypto wasn’t as mainstream. There were no courses on it. As I gained experience, I transitioned into Forex trading and later worked as a broker for Just2Trade and Score Priority. To expand my expertise, I even took on a real estate brokerage in Brooklyn, USA. This helped me cover all angles of the investment world. Now, after years of navigating these markets, I’m ready to share the lessons I’ve learned along the way.

If you’re here, you’re wondering: What’s real trading all about?

How do you stop bleeding money? Can you make a profit in forex? Spoiler alert: Every trader loses at first—it’s part of the learning curve. But the good news is this article will set you up with the essentials. We’ll cover key forex strategies, risk management, and market insights. Plus, we’ll dive into the upsides and traps of forex, along with actionable tips to help you start strong.

By the end, you will have a clearer path to making smarter trades. You will avoid mistakes like revenge trading. You will also step up your forex game.

Ready to stop losing and start winning? Let’s go

Understanding Forex and Its Importance

Forex, or foreign exchange, is the largest financial market globally, where trillions of dollars are traded daily. The forex market allows traders to exchange one currency for another, with prices constantly fluctuating based on supply and demand. It’s a 24-hour market. It operates through major financial hubs like London, New York, Tokyo, and Sydney. This makes it accessible at almost any time.

In April 2022, the forex market saw significant trading activity. Thirty reporting banks recorded a total turnover of USD 367 billion per trading day. This turnover is divided into foreign exchange transactions and interest rate derivatives transactions.

How Forex Trading Works

Imagine you’re in Europe and want to buy a product from the U.S. To pay in U.S. dollars, your euros need to be converted into dollars. This exchange process is the foundation of the forex market. As a trader, you’re speculating on whether one currency will strengthen or weaken against another.

For example:

- If you believe the euro will rise against the U.S. dollar (EUR/USD), you buy euros.

- If the euro does strengthen, you can sell them later for a profit.

Currency values are impacted by various factors, like central bank policies or political events. Price correlation occurs as major currencies are interconnected. For example, if the U.S. dollar strengthens, other currencies, such as the British pound or euro, weaken.

Major Players in the Forex Market

The forex market consists of different participants, including:

- Central Banks: They manage national currencies and influence exchange rates.

- Financial Institutions: Large banks, hedge funds, and investment firms trade currencies in high volumes.

- Corporations: Multinational companies use forex to hedge against currency fluctuations in their international operations.

- Retail Traders: Individual traders like you and me, using online brokers to speculate on currency movements.

Instruments on the Forex Market

There are various ways to trade forex beyond simply buying and selling currencies. These include:

- Spot trading: The most common type where traders buy and sell currencies at the current market rate.

- Futures contracts: Agreements to buy or sell a currency at a specific price at a future date.

- Options: Contracts giving the right, but not the obligation, to trade currencies at a future date.

Leverage is also common in forex, allowing traders to control larger positions with smaller amounts of capital. However, this increases both potential profits and risks.

Forex Trading Sessions

The forex market is open 24 hours a day during the business week. However, activity is concentrated in four main trading sessions. Here’s a table of these sessions, including their approximate times (GMT):

| Trading Session | Major Markets | Active Hours (GMT) |

| Sydney | Australia | 10:00 PM – 7:00 AM |

| Tokyo | Japan, Asia | 12:00 AM – 9:00 AM |

| London | UK, Europe | 8:00 AM – 5:00 PM |

| New York | USA, North America | 1:00 PM – 10:00 PM |

The most active periods are when sessions overlap. Volatility peaks when London and New York are both open (1:00 PM – 5:00 PM GMT). This is when most trading volume happens, creating the best opportunities for traders.

Types of Forex Analysis

Forex traders rely on two main types of analysis to make informed trading decisions: Technical Analysis and Fundamental Analysis. Each approach helps to predict future currency movements based on different data sets. Below, we’ll explore what each type of analysis involves and how traders use them.

Technical Analysis

Technical analysis focuses on historical price movements and patterns in the charts to forecast future price movements. It involves using various tools. It also involves using indicators and chart patterns to decide the best time to buy or sell a currency pair.

Key Concepts in Technical Analysis

- Price Charts: Forex traders analyze price charts over different time frames (e.g., daily, hourly, or weekly) to spot trends and patterns.

- Trendlines: Help decide whether the market is trending up, down, or sideways.

- Support and Resistance Levels: Price levels where the market tends to reverse or stall.

- Example: If EUR/USD consistently bounces off a support level, traders may look for buying opportunities at that level.

- Technical Indicators:

- Moving Averages: Show the average price over a specific period, helping traders identify trends. For instance, the 50-day moving average can indicate a long-term trend.

RSI (Relative Strength Index): Measures the speed and change of price movements to identify overbought or oversold conditions.

Example of a Price Chart with RSI

Traders may decide to buy EUR/USD when the RSI falls below 30 (oversold). They may sell when it rises above 70 (overbought). This helps identify entry and exit points based on price movements.

Fundamental Analysis

Fundamental analysis looks at economic data and global events to predict currency movements. This includes factors like central bank policies, inflation rates, employment figures, and geopolitical developments. Traders use these to gauge the strength of a country’s economy and, in turn, its currency.

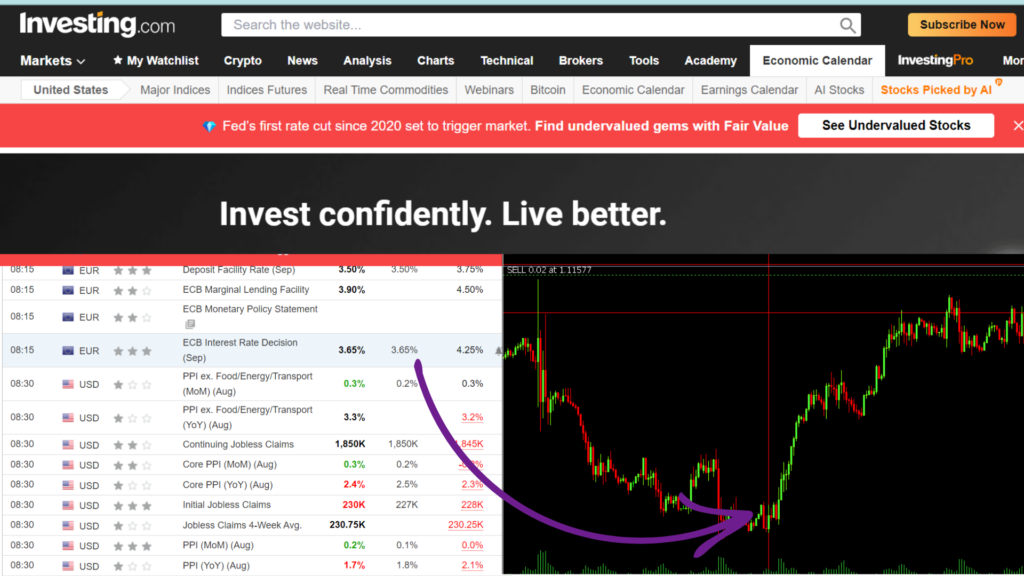

The Economic Calendar

A crucial tool for fundamental analysis is the economic calendar. It lists upcoming economic events and data releases. These include central bank meetings, GDP reports, or employment figures. You can track these events on platforms like Investing.com.

How Economic Events Affect Currency Pairs

- Central Bank Interest Rate Decisions: For example, when the European Central Bank (ECB) raises interest rates, the euro (EUR) tends to strengthen. This usually happens against other currencies. This includes the U.S. dollar (USD). Higher interest rates attract foreign investment, increasing demand for the euro.

- Inflation Data: High inflation often weakens a currency because it reduces purchasing power.

- Employment Data: Strong employment figures usually lead to a stronger currency as they show economic growth.

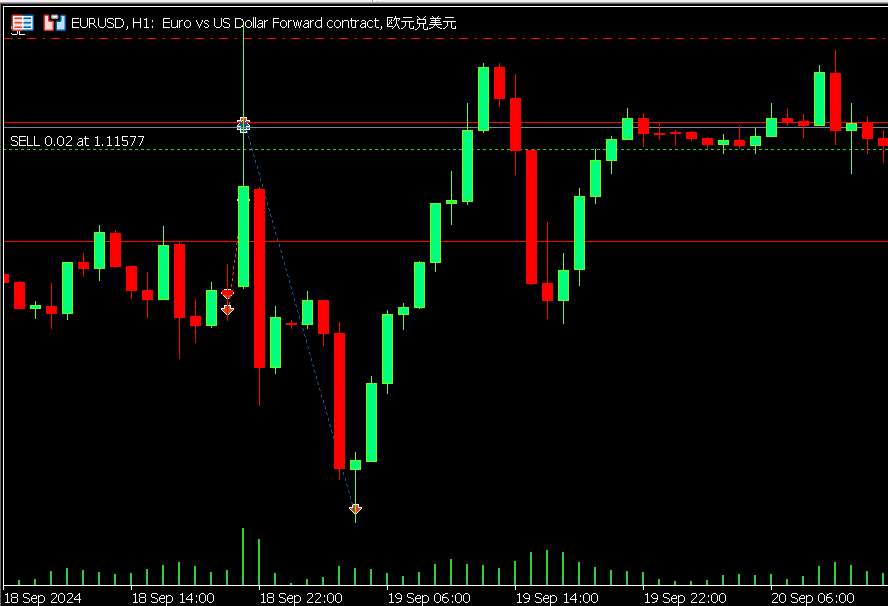

Example: ECB Interest Rate Decision Impact on EUR/USD

When the ECB raises interest rates, the euro tends to appreciate as investors seek higher returns on euro-denominated assets. As a result, EUR/USD may rise in value.

Animated Heading

However, entering trades during major news events can be risky due to high volatility.

For example, one of my students opened a short position on EUR/USD before a FED rate decision. The news caused a sudden price spike in his trade, leading to a loss. Although EUR/USD later resumed its downtrend, the initial volatility proved costly. This shows it’s often safer to avoid trading during major news events, as the market can be unpredictable.

Table: Major Factors That Influence Currency Pairs

Here’s a quick overview of key factors that influence currency movements:

| Factor | Description | Impact on Forex Market |

| Central Bank Interest Rates | Rate decisions by central banks (e.g., Fed, ECB) | Higher rates often strengthen a currency; lower rates may weaken it. |

| Inflation Rates | Measures the increase in prices of goods and services | High inflation typically weakens a currency due to reduced purchasing power. |

| GDP Growth | Gross Domestic Product – a measure of a country’s economic performance | Strong GDP growth strengthens a currency, while slow growth weakens it. |

| Employment Data | Reports like Non-Farm Payroll (NFP) in the U.S. measure job creation | High employment boosts economic confidence, leading to a stronger currency. |

| Political Events | Elections, government policies, and geopolitical tensions | Political stability strengthens a currency; instability or uncertainty can lead to weakness. |

| Trade Balance | The difference between a country’s imports and exports | A positive trade balance strengthens a currency, while a deficit can weaken it. |

| Commodity Prices | Particularly important for currencies tied to commodity exports (e.g., CAD, AUD) | Higher commodity prices can strengthen commodity-based currencies (e.g., oil and gold for Canada and Australia). |

| Market Sentiment | General confidence or fear in the financial markets | Risk appetite strengthens high-yielding currencies, while risk aversion strengthens safe-haven currencies like USD, CHF, and JPY. |

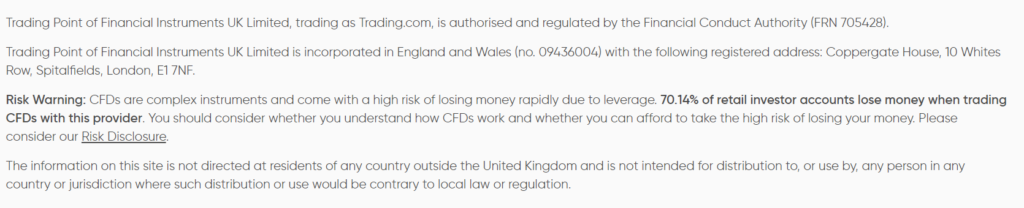

Is Trading.com Legit?

I’ve saved many friends and clients from losing money by investigating how scammers operate in the trading industry. Choosing a reliable broker is crucial, especially with the abundance of fraud in the market. I figured out that there are a lot of questions about Trading.com. I can tell you that after research I wound out that they are registered brokers.

But you should conduct your own research. You can visit Financial Conduct Authority. Always check the register number, that is a key point. That should be official number in financial authority from the country where the company is registered. Pay attention – that is NOT a business registration number. That should be special number from financial regulators that allow trading operations.

Why Choosing a Good Broker is Crucial

Finding a reliable broker is essential to protect your investments. Over the years, I have helped save many friends and clients from falling into the traps of fraudulent brokers. The forex market is unfortunately rife with scams, and traders must exercise caution when selecting a platform.

How to Recognize Scam Brokers

Here are the key factors to consider when choosing a broker:

- Regulatory Approval: Ensure the broker is licensed by reputable regulatory bodies such as the FCA, CySEC, or ASIC. Without this, your funds not be protected.

- Clear Terms and Conditions: Scam brokers often hide fees. They also push for large initial deposits with the promise of high returns.

- Reviews and Testimonials: Research user experiences and reviews to get insights into the broker’s reliability.

- Unrealistic Profit Claims: Be cautious of brokers promising guaranteed profits. These claims are usually signs of a scam.

Trading.com compares well with other legitimate platforms due to its regulation by the FCA. However, always check the broker’s record. Request detailed clarifications to ensure you’re fully protected.

How to Avoid Revenge Trading in Forex (Forex Factory Insights)

Revenge trading is a common pitfall. Traders, driven by frustration or the need to recover losses, make impulsive decisions. These decisions often lead to even greater losses. I understand this from personal experience. I’ve faced the frustration of watching hundreds of dollars disappear. I have also felt trapped in losing trades.

The Psychological Impact of Revenge Trading

When faced with significant losses, it’s easy to fall into the trap of revenge trading. This can lead to pulling stop-loss orders. It can also cause you to deviate from money management principles. For example, you risk more than 3%-10% of your capital on a single trade. This emotional reaction disrupts your strategy and increases the risk of larger losses.

Psychological Impact of Revenge Trading

The emotional fallout from revenge trading is severe. It distorts judgment, increases stress, and disrupts focus. Traders often ignore risk management strategies. They attempt to chase quick wins, which only amplifies losses. This creates a cycle of emotional trading.

Strategies to Avoid Revenge Trading (Forex Factory Insights)

- Acknowledge the Loss: Accept that losses are part of trading and avoid trying to instantly recover them.

- Take a Break: Step away from the screen after a losing trade to cool down and regain perspective.

- Stick to a Trading Plan: Always follow a pre-set trading plan with defined risk limits. Avoid deviating from the plan based on emotions.

- Use Stop-Loss Orders: Set strict stop-loss levels to automatically exit losing trades, preventing emotional decisions.

- Journal Your Trades: Maintain a trading journal. Document not only the trades but also the emotions felt during the process. This can help in identifying emotional patterns and improving discipline.

Importance of Discipline and Emotional Control

Maintaining discipline and controlling emotions are the pillars of successful trading. Mastering these elements ensures that traders stick to their strategies. It helps them avoid rash decisions. Ultimately, this leads to a more consistent and profitable approach. Many experts on platforms like Forex Factory emphasize that disciplined traders are more resilient to market volatility. These traders are also less prone to the pitfalls of revenge trading.

Remember, the desire to win back losses is natural, but the best approach is to avoid trading while emotionally charged. Accept the loss, and return to trading with a disciplined and calm perspective. This approach will help you maintain control and make more rational decisions, ultimately improving your trading outcomes.

How Much of the Forex Market Is EUR/USD Made Of?

EUR/USD is the most traded currency pair in the global forex market, often representing a significant portion of trading volume. Understanding why this pair dominates requires examining its significance, trading volume, and global impact.

EUR/USD: The Most Traded Currency Pair

The EUR/USD pair involves the Euro and the US Dollar. It stands as the most traded currency pair in the global forex market. In October 2023, this pair saw an impressive average daily turnover of $738 billion. This accounted for 25% of the total forex trading volume in London. This dominance highlights the immense liquidity and popularity of the EUR/USD pair among traders.

Since October 2008, the overall forex turnover has experienced substantial growth, rising by 73% from $1,697 billion to $2,928 billion. The EUR/USD pair’s significant share of this volume underscores its critical role in the forex market. This reflects its enduring appeal and pivotal position in global currency trading.

Significance in Global Forex Markets

The EUR/USD pair is a benchmark for forex trading due to several key factors:

- Economic Powerhouses: The Eurozone and the United States are two of the largest and most economically influential regions. They hold significant sway in the world economy. Their economic health significantly impacts global financial markets.

- Liquidity: High trading volume ensures that EUR/USD transactions can be executed quickly and at competitive prices. This makes it attractive for both institutional and retail traders.

- Market Impact: Changes in the EUR/USD exchange rate can influence global trade. It also affects investment flows and economic policies. These factors add to its importance in forex trading.

Why EUR/USD Dominates

Several reasons contribute to the dominance of the EUR/USD pair:

- Economic Stability: Both the Eurozone and the United States have stable and well-established economies. They attract investors and traders seeking reliable trading opportunities.

- Central Bank Policies: The monetary policies of the European Central Bank (ECB) and the Federal Reserve (Fed) significantly impact the EUR/USD exchange rate. This creates numerous trading opportunities.

- Global Trade: The Euro and the US Dollar are key currencies in international trade. Many global transactions involve one of these currencies, which further boosts their trading volume.

In summary, the EUR/USD pair’s dominance in the forex market is due to its high trading volume. It is also influenced by the economic impact of the Eurozone and the US. Additionally, it plays a significant role in global trade and finance.

Is Currency Trading Profitable?

Currency trading, or forex trading, offers potential for significant profit but also comes with substantial risks. The profitability of forex trading depends on various factors including market knowledge, risk management, and strategy. Here’s a comprehensive look at what influences profitability and the realities of trading in the forex market.

Factors Influencing Profitability

- Market Knowledge: Understanding market dynamics, economic indicators, and geopolitical events is crucial. Successful traders continuously analyze global news and data to make informed decisions.

- Risk Management: Effective risk management strategies, such as setting stop-loss orders and managing leverage, are essential. Risking only a small percentage of your trading capital per trade helps protect against significant losses.

- Trading Strategy: A well-defined trading strategy tailored to your risk tolerance and market conditions increases the chances of profitability. Strategies might include technical analysis, fundamental analysis, or a combination of both.

Risks and Rewards

Forex trading offers high potential rewards but also carries significant risks:

- High Leverage: Leverage allows traders to control large positions with a relatively small amount of capital. While this can amplify profits, it can also magnify losses, making risk management crucial.

- Market Volatility: The forex market is known for its volatility. While volatility can create profitable opportunities, it can also lead to rapid and unpredictable losses.

- Emotional Stress: Trading can be stressful, especially during periods of high volatility. Emotional control and discipline are necessary to avoid making impulsive decisions that could lead to losses.

Background on the Forex Market

- Major Players: The forex market is dominated by major financial institutions and central banks. These entities are often referred to as “whales” due to their substantial trading volumes. These entities can influence currency prices through their economic policies and market actions.

- Global Trade: Currency exchange rates are influenced by global trade flows. Exporters and importers play a significant role as they exchange currencies to conduct international transactions. Changes in exchange rates can impact the competitiveness of a country’s goods and services.

- Economic Indicators: Data such as GDP growth, employment figures, and inflation rates affect currency values. Traders use these indicators to forecast future currency movements.

Examples and Realities

- Successful Traders: Notable traders like George Soros and Paul Tudor Jones have achieved significant success in forex trading. Their achievements underscore that while profitability is possible, it requires skill, experience, and a deep understanding of the market.

- Potential Returns: Returns in forex trading can be substantial but are accompanied by risk. Some traders make consistent profits, while others may experience losses. The key is to approach trading with realistic expectations and a solid strategy.

Forex trading can be profitable, but it is not a guaranteed or easy path to wealth. Success in the forex market demands a combination of market knowledge, effective risk management, and a disciplined approach. It is best suited for those who are adaptable, resilient, and prepared for the challenges of the market.

Conclusion

Forex trading is a dynamic and complex field that demands both a solid understanding and a well-defined strategy. As we’ve explored throughout this guide, knowledge of market analysis, trading strategies, and risk management is crucial for success.

To thrive in forex trading, it’s essential to:

- Understand the Basics: Know the core principles of forex trading. Learn how currency pairs are traded. Understand the factors influencing exchange rates.

- Master Analytical Tools: Utilize both technical and fundamental analysis to make informed decisions. Tools like charts, indicators, and economic calendars are vital for effective trading.

- Implement Risk Management: Develop a robust risk management strategy to protect your investments and ensure long-term success.

For those contemplating starting a forex venture, remember one thing. A successful trading business requires careful planning. It also requires adherence to regulations and continuous improvement.

Applying these insights can significantly enhance your trading performance or help you establish a thriving forex business. Whether you’re a novice looking to enter the market or an experienced trader aiming to refine your approach. Utilizing these strategies and tools will set you on the path to success.

For a deeper dive into the fundamentals of forex trading, you can refer to various resources. These include essential techniques and strategies. One such resource is “An Introduction to Forex Trading – A Guide for Beginners” by Matthew Driver. This book offers comprehensive coverage of forex essentials, trading techniques, and advanced strategies that can further enrich your trading knowledge.

Stay informed, stay disciplined, and keep learning to navigate the exciting world of forex trading effectively.

Frequently asked questions

When the Fed raises interest rates, does the dollar generally go up or down?

When the Federal Reserve (Fed) raises interest rates, the dollar generally strengthens. Higher interest rates make U.S. assets more attractive to investors, increasing demand for the dollar. However, the dollar’s reaction can also depend on other factors. These factors include economic data, geopolitical situation, and market expectations. Such factors can affect its response to rate hikes.

How long can I learn forex trading?

The time required to learn forex trading varies based on your background, dedication, and learning approach. Generally, you can grasp the basics within a few weeks, but becoming proficient may take several months to a year of consistent study and practice. Continuous learning and experience are essential for mastering forex trading.

How much is 100 million naira in US dollars?

The conversion rate between the Nigerian Naira (NGN) and the US Dollar (USD) fluctuates. As of the latest rates, 100 million NGN is approximately 218,000 USD. For the most current conversion rates, please check a reliable currency conversion tool or financial news source.

How many forex trading days are there in a year?

There are typically around 252 trading days in a year. Forex trading occurs 24/5 (Monday to Friday), excluding weekends and public holidays.

Generally, does the dollar strengthen or weaken before elections?

Before elections, the dollar can fluctuate depending on political uncertainty and market expectations. The dollar might strengthen as a “safe haven” during periods of uncertainty. This can happen if investors expect the new administration to implement pro-economy policies. Conversely, if elections are accompanied by significant political instability, the dollar might weaken. The dollar may also weaken if the new administration is expected to pursue policies that could negatively impact the economy. The dollar’s reaction depends on various factors, including economic expectations and political conditions. Currently, with Donald Trump running for re-election, market sentiment is particularly sensitive to his campaign rhetoric and policy proposals. If investors perceive his policies as favorable for economic growth, the dollar could see a boost. However, any signs of divisiveness or uncertainty in his campaign might lead to increased volatility. Investors might then seek safer assets, leading to a potential weakening of the dollar.

Do you have to pay tax on forex trading?

Yes, profits from forex trading are generally subject to taxation. The specifics vary by country. It is important to consult with a tax advisor. You should also talk to a financial expert to understand the tax obligations related to your forex trading activities. In some cases your broker is responsible for taxes, but you are always responsible for paying taxes from income.

How to calculate profit in forex trading?

To calculate profit in forex trading, use the formula: Profit=(Exit Price−Entry Price)×Trade Size\text{Profit} = (\text{Exit Price} – \text{Entry Price}) \times \text{Trade Size}Profit=(Exit Price−Entry Price)×Trade Size For example, if you bought EUR/USD at 1.1000 and sold at 1.1050, with a trade size of 10,000 units: Profit=(1.1050−1.1000)×10,000=0.0050×10,000=50USD\text{Profit} = (1.1050 – 1.1000) \times 10,000 = 0.0050 \times 10,000 = 50 USDProfit=(1.1050−1.1000)×10,000=0.0050×10,000=50USD

No responses yet