In the cryptocurrency market, meme coins have emerged as an exciting and distinctive phenomenon. Based on internet memes and popular cultural references, these cryptocurrencies have gained tremendous popularity among crypto enthusiasts and beyond. What started as a lighthearted and informal concept has become a significant trend, with certain meme coins achieving astonishing billion-dollar valuations and even receiving celebrity endorsements.

Here, we analyze key metrics and trends surrounding 35 of the most popular meme coins. By examining market capitalization, trading volume, price performance, and investment amounts, we aim to unlock valuable insights. We will also consider factors that influence the price of meme coins. And discuss whether most investors earn or lose when investing in meme coins.

In previous articles, we discovered how to trade and what NFT is. In this article, I offer you to take a look at the investment statistics of Meme coins. It will help you figure out and decide if it is possible to earn money from investing in meme coins.

The Meme Coin Universe

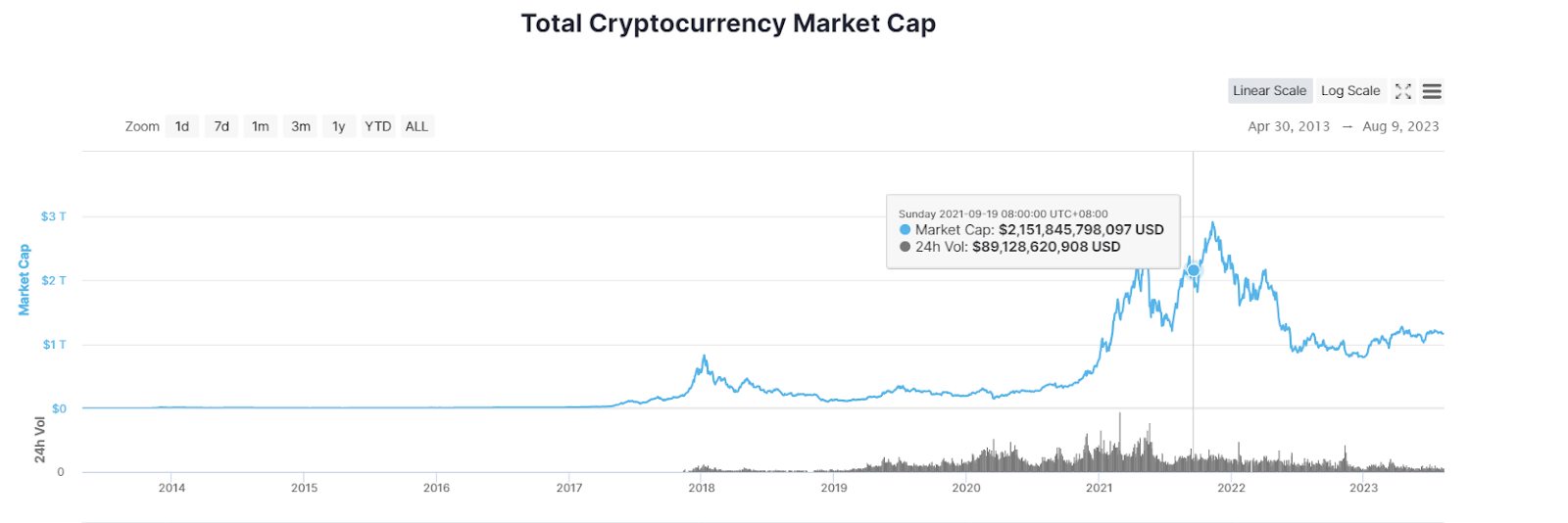

As of 08/09/2023, the market capitalization of meme coins stands at a relatively low of $17,940,984,206 compared to the total cryptocurrency market capitalization of $1,180,000,000,000. Despite their modest overall market value, meme coins have a unique history of skyrocketing prices, often experiencing exponential growth.

The evolution of meme coins

The first meme coin, Dogecoin, was created in 2013 by Billy Markus and Jackson Palmer as a fun and lighthearted cryptocurrency based on the popular Doge meme. Since then, meme coins have become a popular trend in the cryptocurrency market, with many new coins emerging based on various internet memes and humorous characteristics.

Meme coins have gained popularity due to their viral nature and the power of social media. These coins are designed to be shared and promoted through online communities, making them accessible to a large audience.

Who are the major investors?

Retail investors are one of the significant investors in meme coins. They are often attracted to meme coins due to their low prices and the potential for high returns. In 2022, many retail investors started buying meme coins out of fear of missing out on an opportunity to become overnight millionaires. The absence of retail investors can also impact the price of a meme coin, as seen in a Santiment report. Retail investors remain a significant player in the meme coin market despite the risks involved in investing in meme coins.

Social media influencers and celebrities have also played a significant role in the rise of meme coins. They often promote these coins on their social media platforms, which can lead to a surge in demand and price. We will consider the major factors influencing price formation later in the article.

Statistic Data Meme coins

Despite the major holders being retail investors, investments below the $100 threshold may not yield substantial insights into price formation dynamics due to their relatively minor impact. In financial markets, smaller investments often carry less weight in influencing overall price trends. Analyzing transactions below $100 may introduce noise and obscure meaningful patterns that drive significant price movements. As a result, focusing on transactions exceeding this threshold allows for a more refined analysis, capturing the actions of investors whose contributions are more likely to have a discernible impact on price formation processes.

Source: https://dune.com/queries/2776526/4622611

The list of coins analyzed

In this investigation, our focus was directed toward a comprehensive analysis of the most prominent meme coins within the cryptocurrency landscape. Our methodical approach examined various facets of these meme coins, including their market presence, trading activity, investment trends, and associated outcomes.

The subsequent sections of this report encapsulate the findings garnered from our investigation, shedding light on the substantial investments channeled into meme coins and the consequential ramifications thereof. The empirical evidence presented herein aims to provide a comprehensive and objective overview of the investment dynamics within the meme coin domain, thereby facilitating a deeper comprehension of their market influence and potential implications.

Source: https://dune.com/queries/2794067/4655489

Investments Overview

As of April 2021, there was a noticeable increase in investments, which coincided with an increase in activity. There was a discernible trend in May as numerous investors sold their holdings, suggesting a speculative component of these investments. Notwithstanding, a subset of investors may have garnered favorable returns during this period.

August and September 2021 witnessed prominent divestitures of meme coins, a phenomenon dissociated from the broader context of total market capitalization. This decoupling underscores the relative autonomy of meme coins within the market dynamics, prompting the exploration of alternative variables that influence their price dynamics.

Source: https://coinmarketcap.com/charts/

October 2021 registered a substantial influx of investment activity, albeit marginally less pronounced than in prior periods, denoting a recalibration of investment sentiment.

Progressing through October 2022, the landscape remained relatively devoid of substantial inflows or outflows. Noteworthy withdrawals surfaced in September and December of 2022, extending their influence into May 2023. Intriguingly, this year’s May saw a renewed surge of interest in meme coins, accentuating the evolving dynamics surrounding these assets.

Subsequent chapters will delve into specific meme coin instances that experienced the most pronounced all-time investment influx, unraveling the nuances inherent to this captivating facet of cryptocurrency.

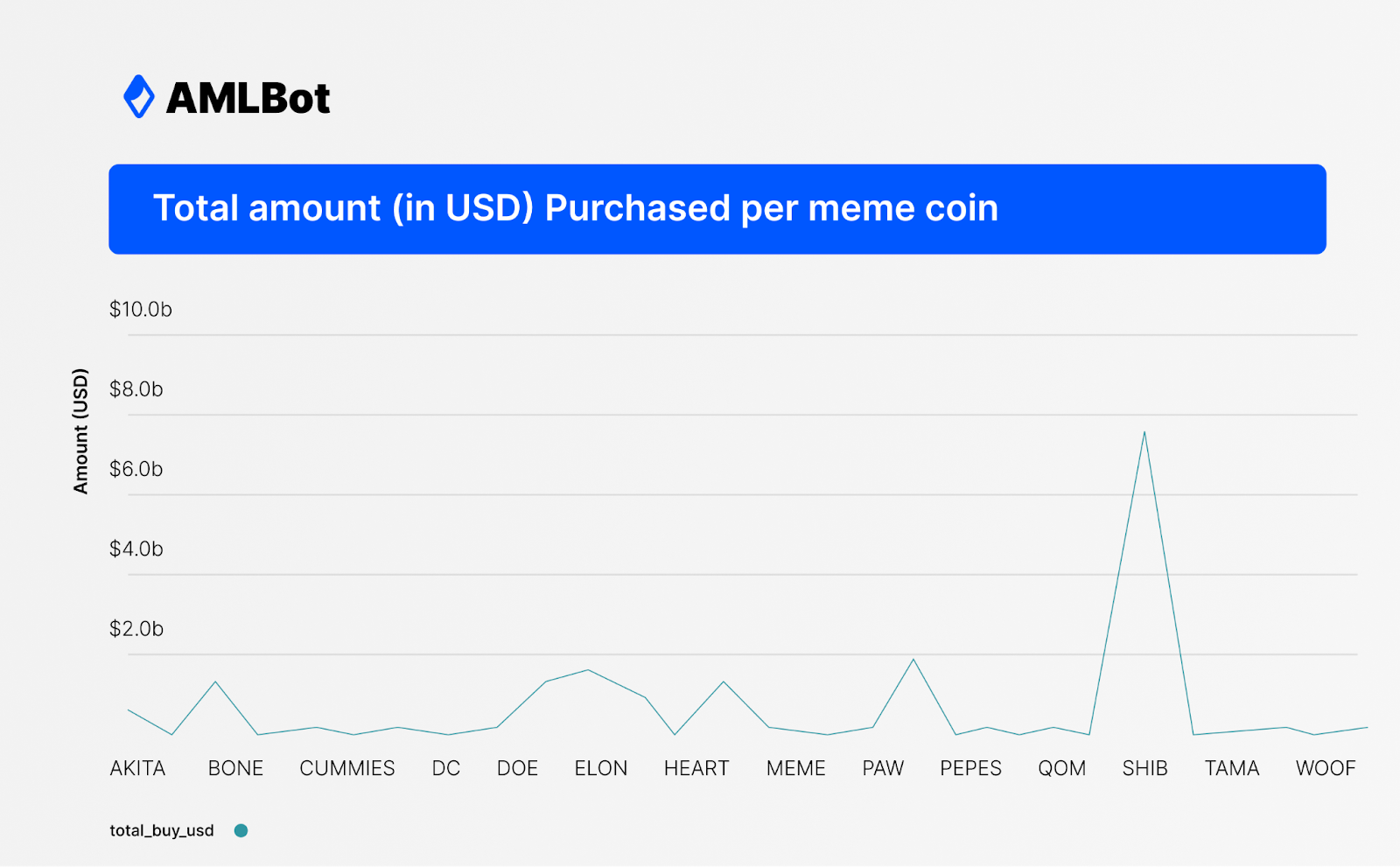

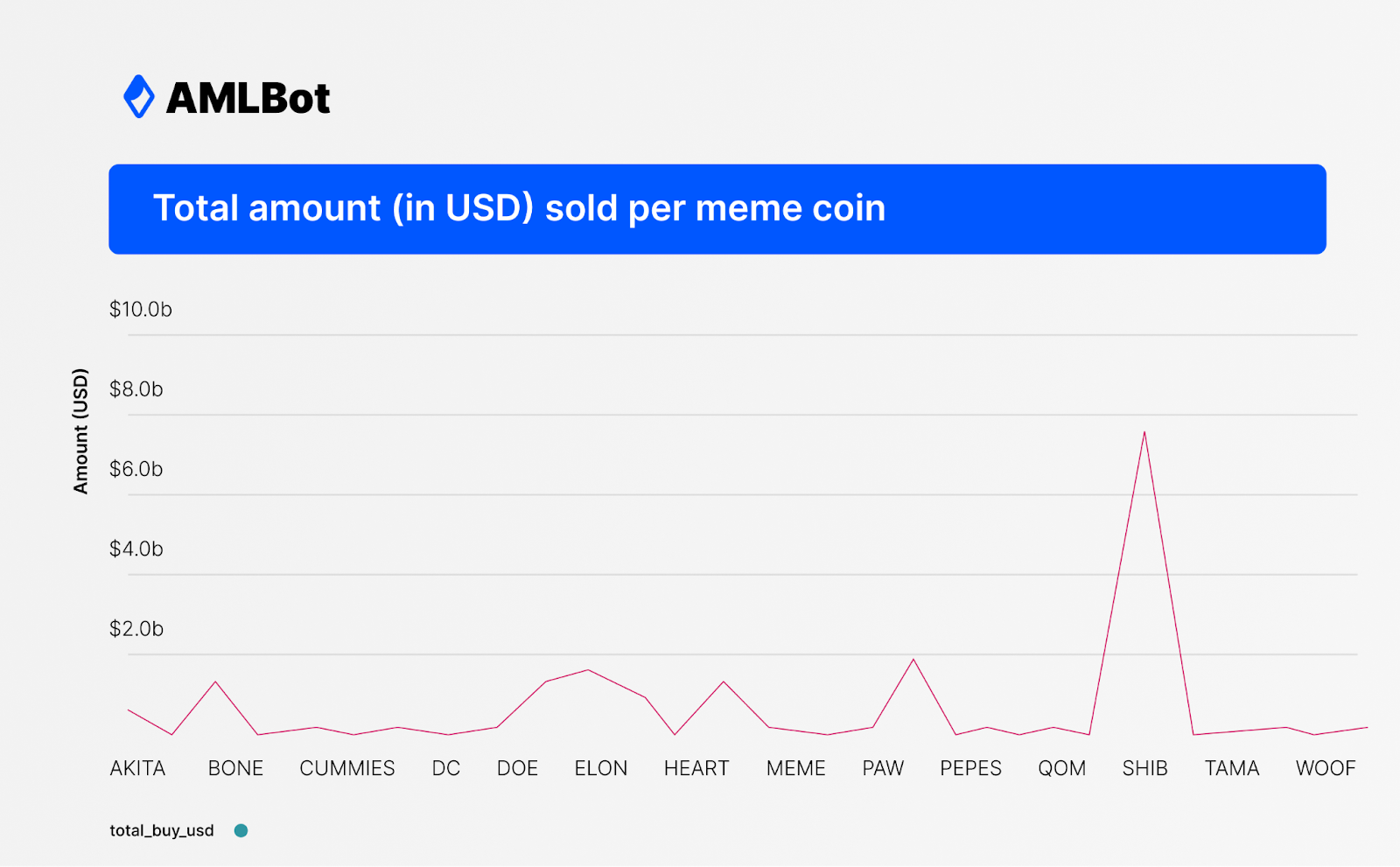

Total amount invested

The preeminent capital inflows gravitated towards the SHIB coin, commanding a substantial total of 10.1 billion. Following closely, PEPE secured the second position with an influx of $2.4 billion, while ELON trailed closely behind with $2 billion.

Contributing to this financial landscape, LEASH garnered a noteworthy investment of $1.8 billion, while DOGE and BONE followed suit with $1.6 billion and $1.7 billion, respectively.

Subsequent projects in the hierarchy displayed relatively lesser capital infusions, ranging from $15.9 million to $207.9 million, capturing varying degrees of market interest and investment commitment.

Source: https://dune.com/queries/2794067/4653106

Total investments sold

The cumulative investments divested portray a discernible pattern. BONE is the most considerable loss-bearing investment, accounting for a substantial $1.9 billion. ELON and LEASH closely follow suit, with investment losses amounting to $2.1 billion and $1.9 billion, respectively.

However, a nuanced perspective arises when examining coins with comparatively modest investments. For instance, DC reflects an investment of $224.6 million and a divestiture of $223.4 million. This nuanced scenario suggests an enduring interest among holders in the project, potentially signaling a sustained commitment to its prospects.

Source: https://dune.com/queries/2794067/4653078

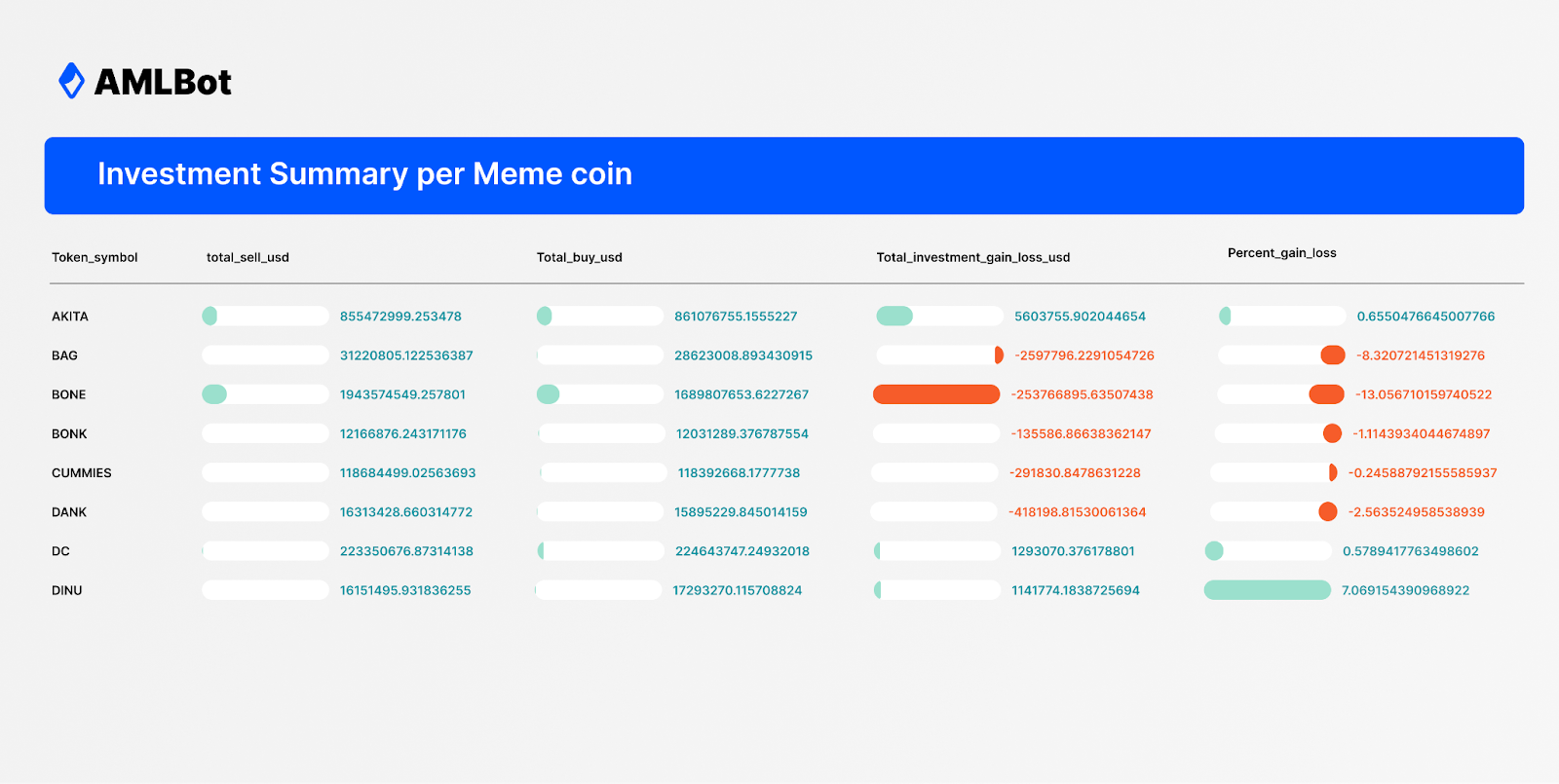

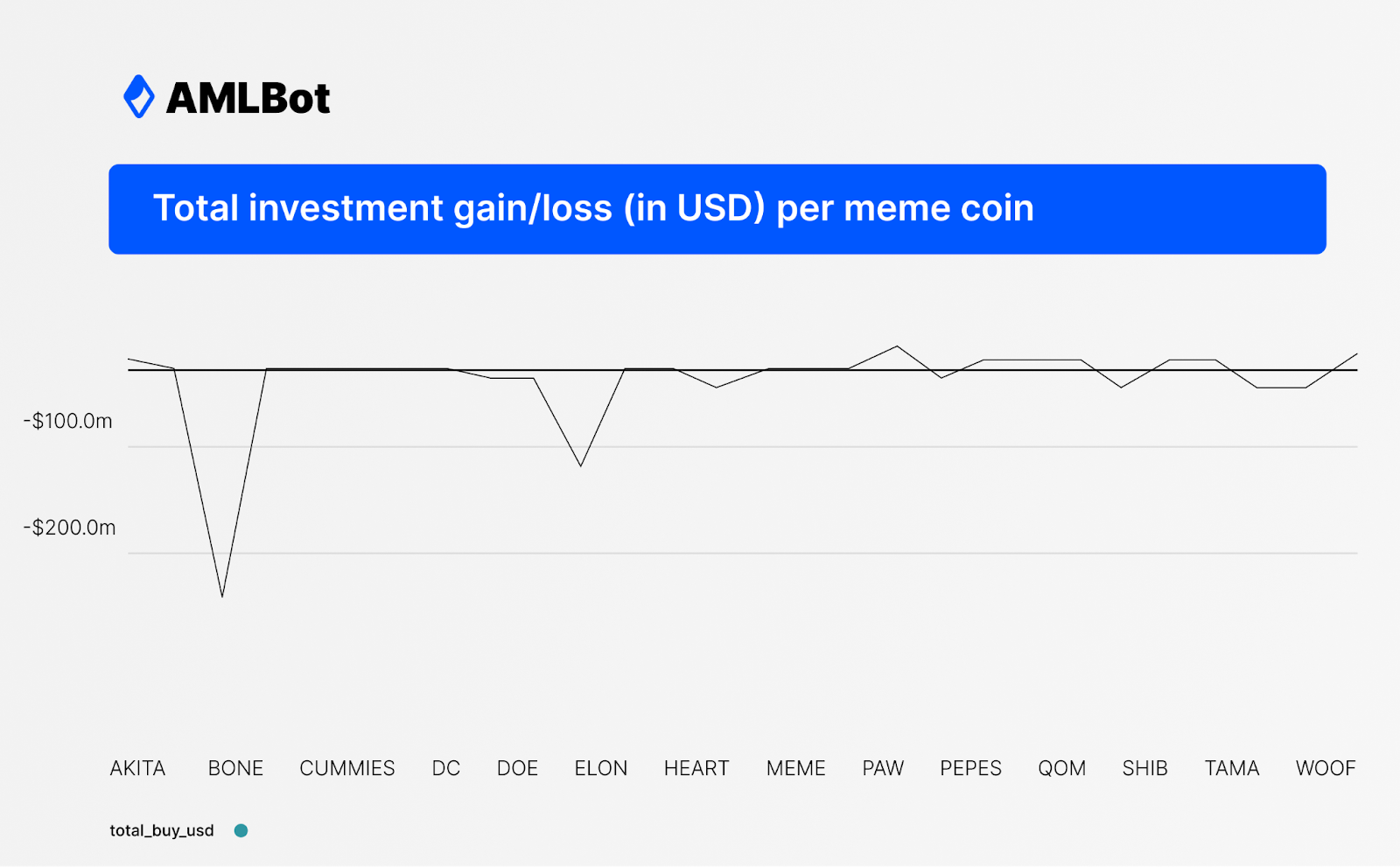

Total investment gain/loss

The total investment gain and loss assessment present a revealing contrast, elucidating the projects that have yielded favorable returns and those that have proven less promising for most investors. While acknowledging the potential variation in individual traders’ short-term or long-term gains, the overarching data underscores a scarcity of projects manifesting positive trends during this period.

Within this context, certain projects stand out as exceptions, exhibiting encouraging dynamics:

AKITA: Demonstrating a gain of $5.6 million

DINU: Notching a notable gain of $1.1 million

DC: Reflecting a positive trajectory with a gain of $1.3 million

PEPE: Evidencing significant promise with an impressive gain of $18.1 million

Amidst the broader landscape, these projects provide a glimpse of positivity, hinting at the potential for profitable returns within the meme coin domain.

Source: https://dune.com/queries/2794067/4653118

Total investment gain/loss

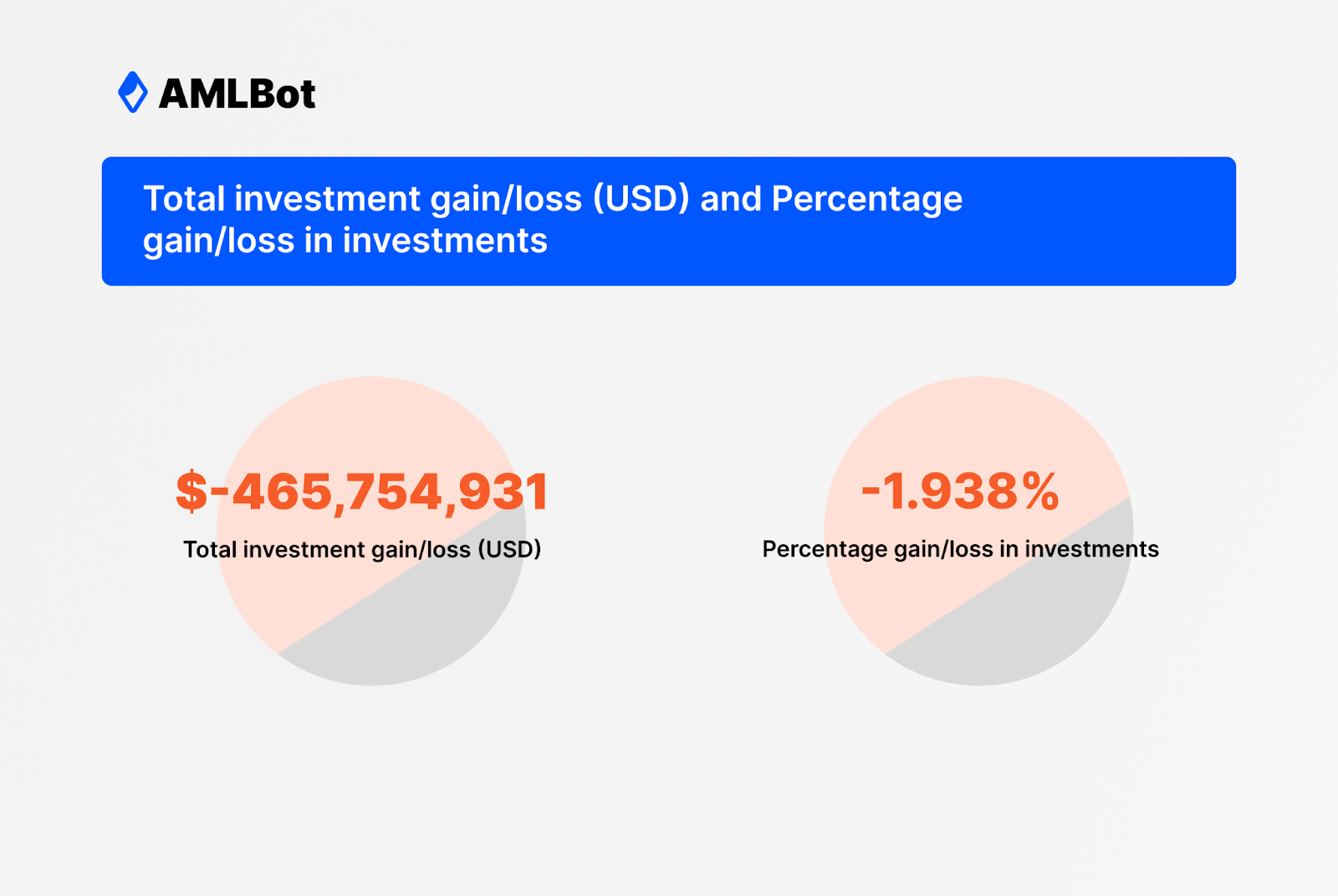

While certain investors and traders managed to reap profits from meme coins, the overarching trend highlights a prevalence of selling over purchasing. This observation raises the inference that, at present, meme coins may not fulfill the criteria of a lucrative investment avenue. Notably, only a limited selection of projects exhibit a positive trajectory in their dynamics, underscoring the challenges associated with meme coin investments.

The total investment gain/loss shows a decrease of -$465,754,931, indicating a drop in overall investment value. This results in a percentage loss of -1.938%, reflecting a decline in investment returns over the analyzed period.

Source: https://dune.com/amlbot_/meme-performance-dashboard

What influence on meme coins’ price?

While predicting the future remains uncertain, it is evident that some individuals have achieved gains through their engagement with meme coins. In this exploration, we will delve into the factors contributing to the fluctuation of meme coin prices. By understanding these underlying influences, traders and short-time investors can react quickly and take some profit on a short time base or a long perspective.

Market Sentiment and Speculation

The report indicates that the largest investments occurred during the crypto rally, highlighting the influence of market sentiment and speculative behavior on meme coin prices. Favorable developments, such as partnerships and celebrity endorsements, generate optimism and stimulate demand, resulting in price appreciation. Conversely, negative news or regulatory concerns can instill a pessimistic sentiment and lead to price declines. Grasping market sentiment and speculation is crucial for successfully navigating the ever-changing realm of meme coins.

In August and October 2022, a wave of uncertainty swept through the market, triggering a withdrawal of investments as confidence waned.

News players with a major impact

However, as we fast forward to 2023, a fresh wave of enthusiasm has emerged among investors.

As we delve into the numbers, it becomes evident that investor interest in meme coins began to percolate in April 2023, signaling the start of something extraordinary on the horizon. The fervor only intensified in May 2023.

And the catalyst behind this resurgence is the launch of the illustrious PEPE 2.0 coin launch.

This captivating newcomer has taken the crypto world by storm, setting a record-breaking example of an astounding 7,000% rally since its much-anticipated launch in April 2023. Within a month, the PEPE coin has soared to a staggering market capitalization of over $5 billion, leaving enthusiasts and analysts awestruck at its meteoric rise.

Another good example of a major player is the SHIB launch. We see how in October 2021, they hit the moon.

Which influences whole investments.

When reputable and well-established entities step into the meme coin arena, they bring a sense of credibility and trust that resonates with investors. This added confidence sparks renewed enthusiasm, driving both existing and new investors to take notice and allocate their funds.

These new players have the potential to inject fresh energy and momentum into the meme coin market. Their entry is often accompanied by strategic moves, such as partnerships with renowned brands, endorsements from influential figures, or innovative marketing campaigns that capture the attention of the masses.

Social Media and Online Communities

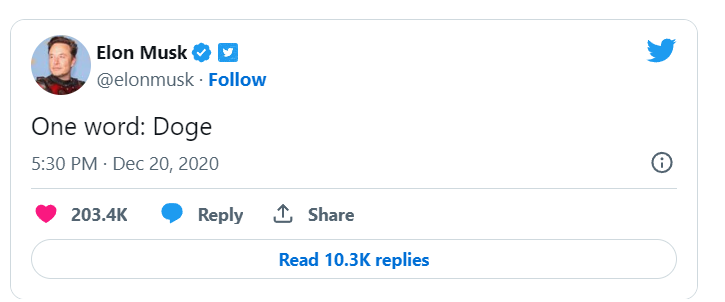

Social media platforms and online communities play a crucial role in shaping the price movements of meme coins. Platforms like Reddit, Twitter, and various online communities significantly influence the cryptocurrency. With its origins rooted in memes, meme coins built a solid and vocal online community that actively promotes and discusses this digital currency. These communities drive trends, create viral memes, and even coordinate buying efforts, leading to substantial price surges, as witnessed during the “Doge Army” campaigns.

For example:

One Musk tweeted, “One Word: Doge,” there were reports that the trading volume of DOGE/USDT increased significantly. Before the tweet, the average trading volume was around $1,942, with nine trades per minute. However, in the 30 minutes following the tweet, the average trading volume per minute increased to $299,330, with 775 trades per minute.

In May 2021, Elon Musk’s lighthearted mention of DOGE on television had an unexpected effect. Traders shifted their attention to other meme coins, causing a dip in the price of DOGE. However, as we can see from a chart, that has a relatively small influence on investing and trading behavior, as the most significant losses traders gain in October 2021.

2023 example is the PEPE coin

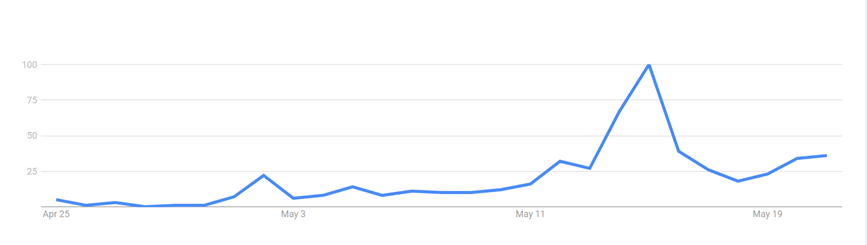

The Google Trend score for “PEPE coin” rose from three to 100 from April 9, 2023, to May 15, where the value 100 depicts the peak popularity for a keyword search on Google.

That also could influence the total market capitalization of meme coins, and as we see, we have significant investments in May 2023.

Mainstream Adoption and Integration

The price of meme coins can be significantly affected by their widespread acceptance and incorporation as a means of payment or investment. When merchants, online platforms, or financial institutions embrace meme coins and utilize them in various transactions, their usefulness is enhanced. It generates greater demand, ultimately leading to a positive impact on their price. Conversely, if meme coins face limited adoption or regulatory obstacles, their growth potential may be improved, positively impacting their price.

Several prominent companies have already taken the initiative to accept meme coins like Dogecoin and Shiba Inu as valid forms of payment.

These companies include:

- GameStop

- Newegg

- Nordstrom

- Tesla

- AMC Entertainment

In 2021, Slim Jim, the well-known beef jerky snack company, made an interesting shift in its marketing and social media strategy by embracing Dogecoin. This move generated significant attention and growth for the company on Twitter. According to Lanie Friedman, a spokeswoman for Conagra Brands, the parent company of Slim Jim, their Twitter presence has expanded fivefold since they began tweeting about Dogecoin in February. However, whether this increased online engagement has translated into a boost in sales for Slim Jim remains to be seen.

Impact of Overall Market Conditions on Meme Coins

A range of elements, including market volatility, alterations in regulations, significant macroeconomic occurrences, and the overall sentiment of investors toward cryptocurrencies, can trigger a cascading effect across the market. Uncertainty or pronounced price oscillations within other cryptocurrencies can prompt investors to shift their focus toward more established assets, contributing to price fluctuations within meme coins.

However, the influence of these factors, commonly referred to as market sentiment, tends to be relatively limited regarding meme coins. Instead, these coins’ value dynamics are more profoundly shaped by factors such as the responsiveness of the projects’ communities and other specific situational contexts.

Bitcoin’s Influence – Myth

There is a prevailing misconception surrounding Bitcoin (BTC), one of the leading cryptocurrencies, suggesting that it significantly influences the broader crypto market, including meme coins. It is commonly assumed that investors and traders closely monitor Bitcoin’s price as an indicator of market trends, affecting the demand and price of meme coins.

However, this notion needs to be revised. For example, in reality, Bitcoin exhibits a relatively low correlation coefficient with meme coins like DOGE, averaging at 0. 2. This means that the price movements of Bitcoin have a minimal direct impact on meme coins, challenging the belief that Bitcoin acts as a reliable predictor of their demand and value.

Is a meme coin a good investment?

In light of the analysis conducted earlier, it becomes evident that meme coins hold a unique position within the cryptocurrency landscape. Their low prices, susceptibility to market events, and often whimsical origins contribute to their reputation as speculative assets rather than stable investment options.

The data presented underscores that while some active traders and crypto enthusiasts may have seized short-term profit opportunities through meme coins, most investors’ overall landscape is characterized by losses. The statistics consistently demonstrate that the total investments in meme coins have led to substantial losses, painting a cautionary picture for those considering meme coins as a significant investment strategy.

While experienced traders with a high tolerance for risk might find room for maneuvering within the volatile meme coin market, the average investor seeking steady and predictable returns is likely to find meme coins ill-suited for their portfolio. The data-driven insights and the historical analysis point towards a trend of unfavorable returns for the majority.

As a result, potential investors are advised to approach meme coins with extreme caution. Robust research, a clear understanding of the risks involved, and a willingness to allocate only discretionary funds are vital when venturing into meme coin investments. Diversification and a prudent and measured approach to risk management remain essential strategies to navigate the speculative landscape of meme coins effectively.

Conclusions

In 2021, we witnessed an unprecedented boom in the popularity of these coins, fueled by internet memes and celebrity endorsements. Meme coins experienced meteoric price surges, capturing the attention of crypto enthusiasts and mainstream investors.

However, the boom of 2021 was followed by a period of decline and uncertainty in 2022. Lack of investor confidence and regulatory concerns resulted in significant withdrawals from the meme coin space, causing a dip in investment and trading activity. Despite this setback, 2023 has shown signs of renewed interest, with investors cautiously returning to the market.

One notable catalyst for this renewed interest is the entry of new players with a strong background. Reputable brands, influential figures, and strategic partnerships have injected fresh energy into the meme coin market, drawing substantial investments and igniting optimism. The launch of the “PEPE” coin in April 2023 is a prime example, where a crazy rally of almost 7,000% in just a month captured the imagination of investors, resulting in a market capitalization of over $5 billion.

Marketing, social media, and the influence of great personalities, particularly power meme coins. Platforms like Reddit, Twitter, and various online communities are pivotal in shaping their price movements. Engaging marketing campaigns and endorsements from influencers like Elon Musk have directly impacted meme coin prices, highlighting their strong connection with popular culture and online communities.

The total investments in meme coins present a revealing picture of the market’s dynamics. The latest available data shows that the overall dollar amount is approximately—$77,166,609,888. This represents the net gain or loss of investments in meme coins over the analyzed period.

It’s important to recognize that meme coins are not traditional investments but are driven by people’s sentiments and cult-like enthusiasm. They are highly speculative assets, making them prone to extreme price fluctuations. As a result, most investors who have ventured into the meme coin space have experienced losses rather than gains.

While meme coins can offer exciting opportunities for short-term gains, they remain inherently volatile and speculative. As a result, the total investments in meme coins may fluctuate dramatically, influenced by market sentiment, social media trends, and the involvement of influential figures.

No responses yet