Information, in some cases, costs more than money. You have surely wondered about the inner workings of the market and why smart money is the key to success in trading. This article will demystify the market’s core dynamics and the art of Market Making.

Artificial intelligence and marketing guide price movements, considering essential factors and taming market volatility. These orchestrated movements give rise to various trends, prompting traders to make pivotal decisions.

To excel in this environment, mastering the art of identifying and adapting to Smart Capital’s strategies is crucial. The good news? Specialized tools exist for this very purpose.

While we can’t reveal all market secrets, we’re here to share valuable insights, practical tools, and illuminating illustrations. Join us on this journey where profits await, and Smart Money becomes your trusted ally.

- Trading instruments

- Trading System Overview

- Trading sessions

- Swing High and Swing Low: Unlocking Market Dynamics

- Mastering Market Structure for Trading Success

- Types of structures

- Law of Effort (LoE)

- Fibonacci

- Risk management

- Liquidity

- Candle Shadows

Trading instruments

Technical analysis instruments

The tools of technical analysis are the basis for its success. You should know a lot of them, but it is better to concentrate on the basics and not to be overwhelmed.

| Instrument | Purpose | ||

| Traidingview | a universal platform for analyzing charts, comfortable interface | ||

| Notion.so | keeping the journal of deals | ||

| Сointracking | Allows to make analysis of your trades from all exchanges (link with 10% discount) |

Fundamental analysis instruments

Fundamental instruments vary based on assets and strategy. Beware of excessive positive/negative news, which could signal market manipulation, especially in Market Making. Stay informed and research diligently.

| Instrument | Purpose | |

| Alternative | Measures market sentiment through a fear and greed index | |

| Coinmarketcap | Provides information on crypto prices, market caps, and trading volumes | |

| Tokenterminal | Offers metrics and data for various blockchain projects | |

| Dappradar | Analyzes decentralized applications (DApps) and provides insights into their performance | |

| Defillama | A comprehensive DeFi analysis platform displaying DeFi protocols, chains, categories, and liquidity pools |

Trading System Overview

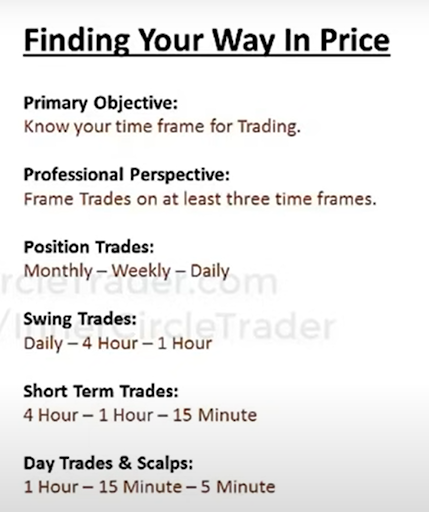

1. Identifying HFT Zones of Interest:

-

- HFT Focus Timeframes:

-

- Monthly – Weekly – Daily

-

- Daily – 4 Hour – 1 Hour

-

- 4 Hour – 1 Hour – 15 Minute

-

- 1 Hour – 15 Minutes – 5 Minutes

-

- HFT Focus Timeframes:

-

- Choose one HTF priority option.

2. Zone Identification Criteria:

-

- Analyze structural elements in descending trend sizes.

-

- Identify bos (breakout) levels in all LTFs (Lower Time Frames).

-

- Mark key points after bos LFTs to search for a TVF (Trend Validation Factor) continuation in HTF trends.

-

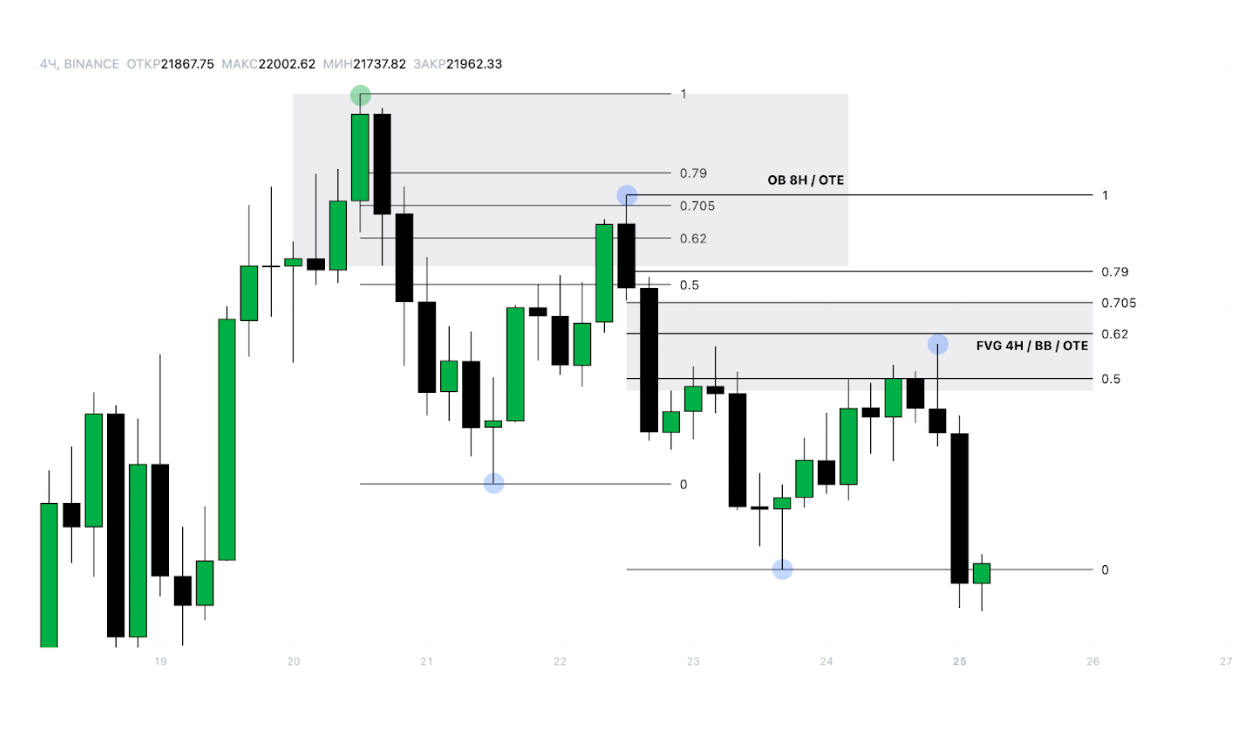

- Define OTE (Optimal Trade Entry) and consider entries from at least 0.5.

-

- Identify OB (Overbought), MidB (Midrange Break), and other crucial support/resistance zones.

-

- Determine FVG (Fibonacci Value Gap) zones.

3. Execution:

-

- Execute trades with a minimum 1:3 Risk-Reward ratio.

4. Risk Management:

-

- Apply risk management by limiting each trade’s stop loss to 5% of the deposit.

5. Trade Analysis:

-

- Conduct in-depth analysis and derive insights from a history of 100 entries.

This structured approach ensures a methodical and strategic trading system, enhancing your chances of success in the market.

Trading sessions

The opening of transactions should fall on the opening of London, in this case will be the best time to be in the transaction. The main volatility falls on the American session, where it is necessary to close transactions and wait for the opening of a new day to find the next transactions.

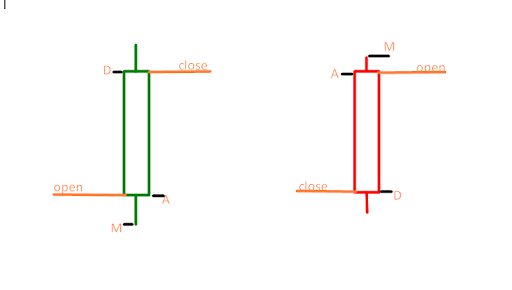

The Power of Three in Market Cycles

Understanding the “Power of Three” is like holding the keys to a secret kingdom. This trio of market cycles – Accumulation, Manipulation, and Distribution – is the blueprint that massive capital follows to build its formidable position. And the daily timeframe (TF) serves as our trusty compass in deciphering these cycles.

1. Asian Opening – The Phase of Accumulation (A)

-

- Picture this as the calm before the storm. Here, the giants of finance quietly gather their resources, accumulating positions.

2. London Opener – The Art of Manipulation (M)

-

- As London’s financial hub springs to life, manipulation takes center stage. Liquidity is swiftly withdrawn from the opposite side of the spectrum, only to be rapidly injected back in, often forming Overbought (OB) patterns or other intriguing formations.

3. New York Opening – The Prelude to Distribution (D)

-

- With the grand stage set by manipulation, the New York opening marks the beginning of distribution. The price consolidates, preparing for a breakout in the intended direction. This is where we witness aggressive movements, often associated with the American session. As the session concludes, a massive dumping of positions occurs, leaving behind the telltale shadow candle.

Senior timeframes

Opening HFT candlesticks determines the most profitable zones to enter a position. These zones act as an additional decision factor.

Swing High and Swing Low: Unlocking Market Dynamics

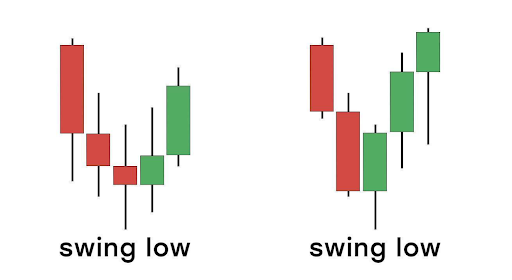

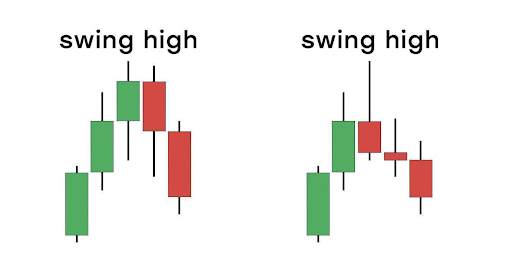

In the trading world, “Swing High” and “Swing Low” are critical concepts. They represent the price extremes before a change in direction. To identify these crucial points, a reliable method involves a 5-candle formation. This formation unveils significant market interest at specific price levels.

To spot crucial formations effortlessly, TradingView offers the “WICK.ED Fractals” indicator. With this tool and the power of 5-candle swings, traders can make more informed decisions and enhance their trading strategies.

Mastering Market Structure for Trading Success

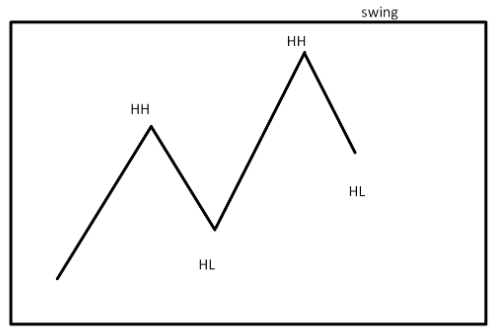

Market structure is the backbone of trading. It comprises a series of highs and lows that serve as a roadmap for gauging trends and predicting future price movements. A trend represents the dominant price direction, following the path of least resistance. In trading, the market can be in one of three states: an uptrend, a downtrend, or a flat market. Understanding and identifying these states are vital for making informed trading decisions and achieving financial success.

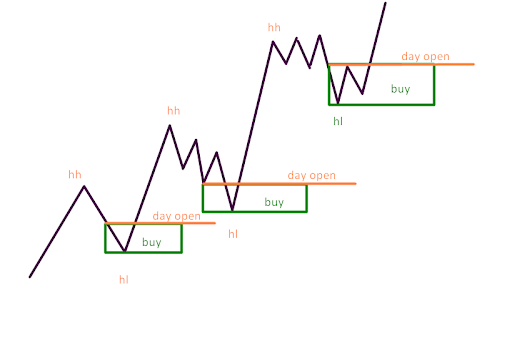

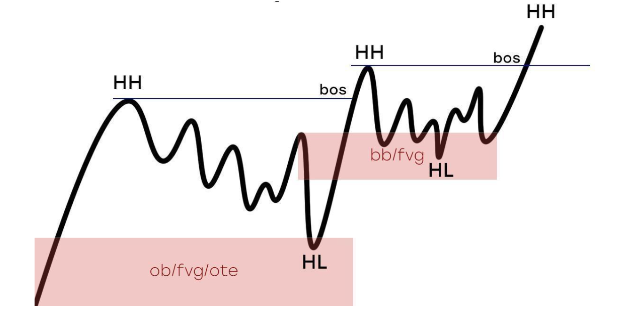

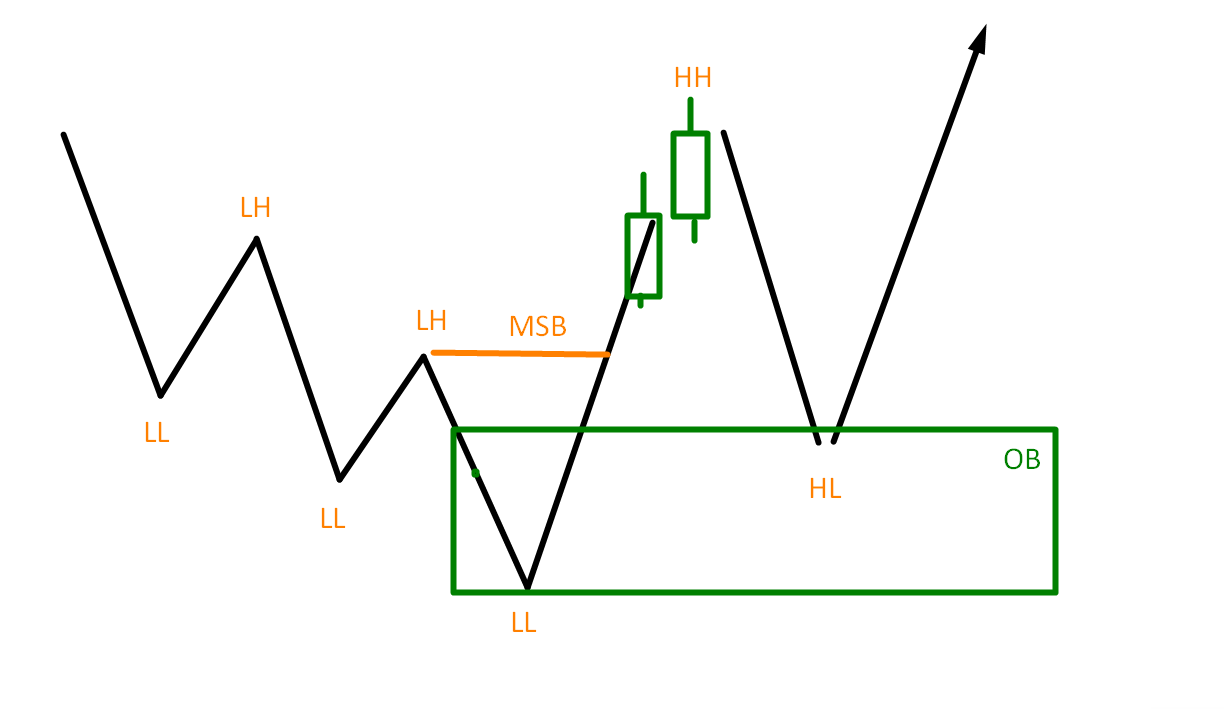

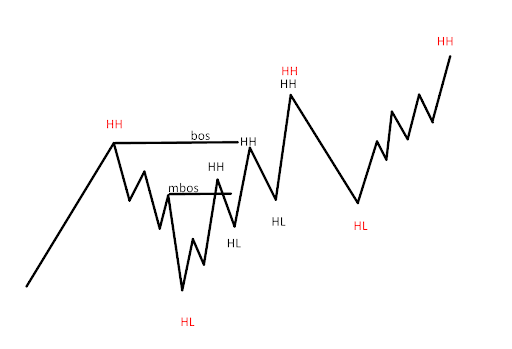

Uptrend

An uptrend is defined by a series of rising higher and lower highs. The key event in an uptrend is the breakout (BOS), which typically occurs impulsively, followed by a corrective phase known as the range. After the formation of a higher high, a higher low is established, serving as a strategic entry point for traders looking to capitalize on the trend’s continuation. This is followed by another breakout (BOS), expansion, and subsequent correction, marking the cyclical nature of an uptrend. Understanding these dynamics is crucial for traders seeking to thrive in bullish market conditions.

When assessing market structure, note that a higher low (HL) is more reliable when it forms from a support area, minimizing the likelihood of a local update. In cases where the HL is isolated without significant support, it can be the initial target for triggering stop orders if a further decline ensues. This strategic approach enhances risk management and trade execution.

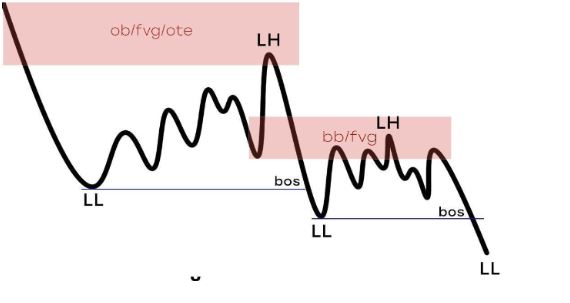

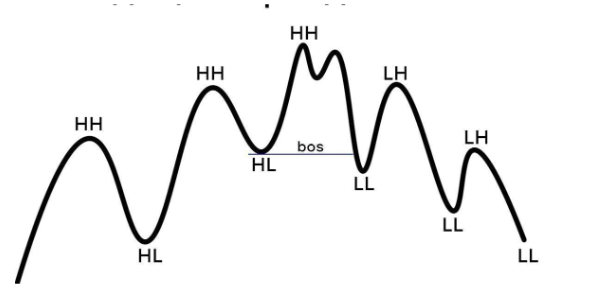

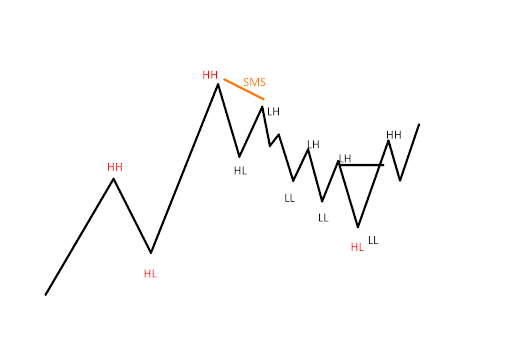

Downtrend

In a downtrend, the principles are analogous to those of an uptrend but in the opposite direction.

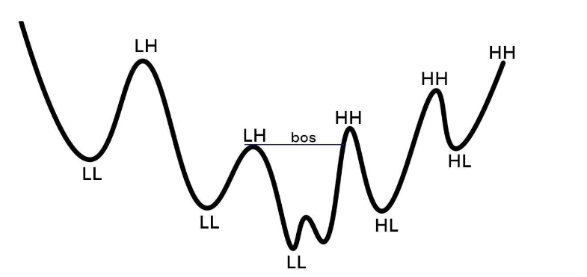

Breakdown of the downtrend structure

Breaking the trend

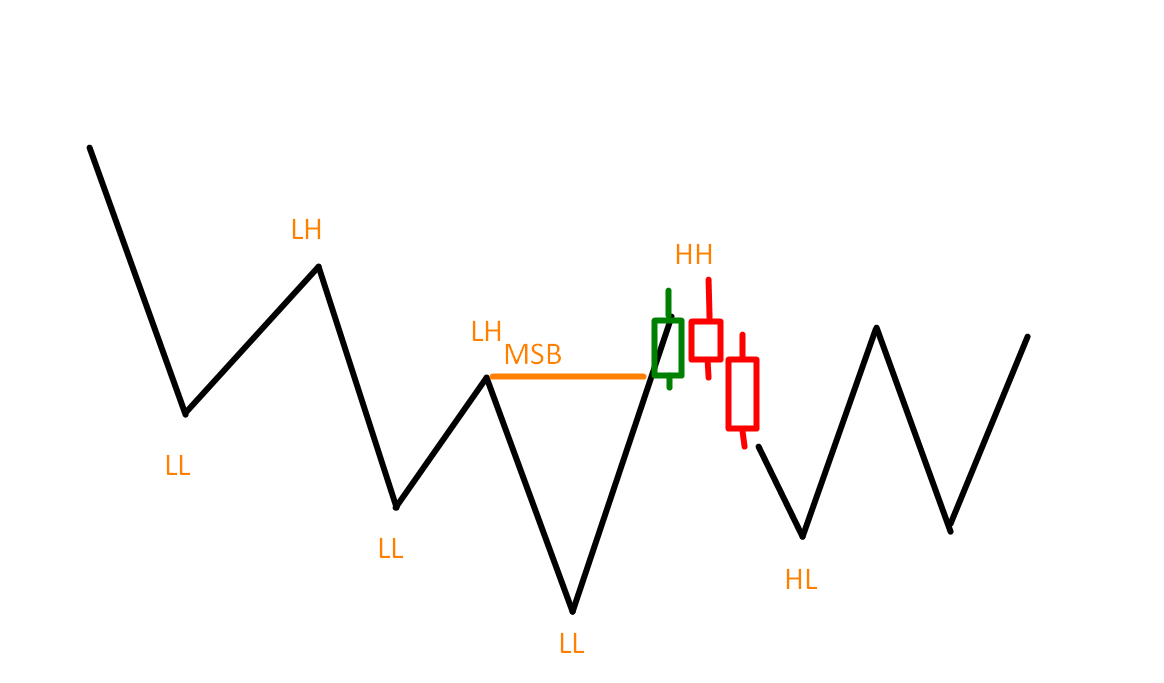

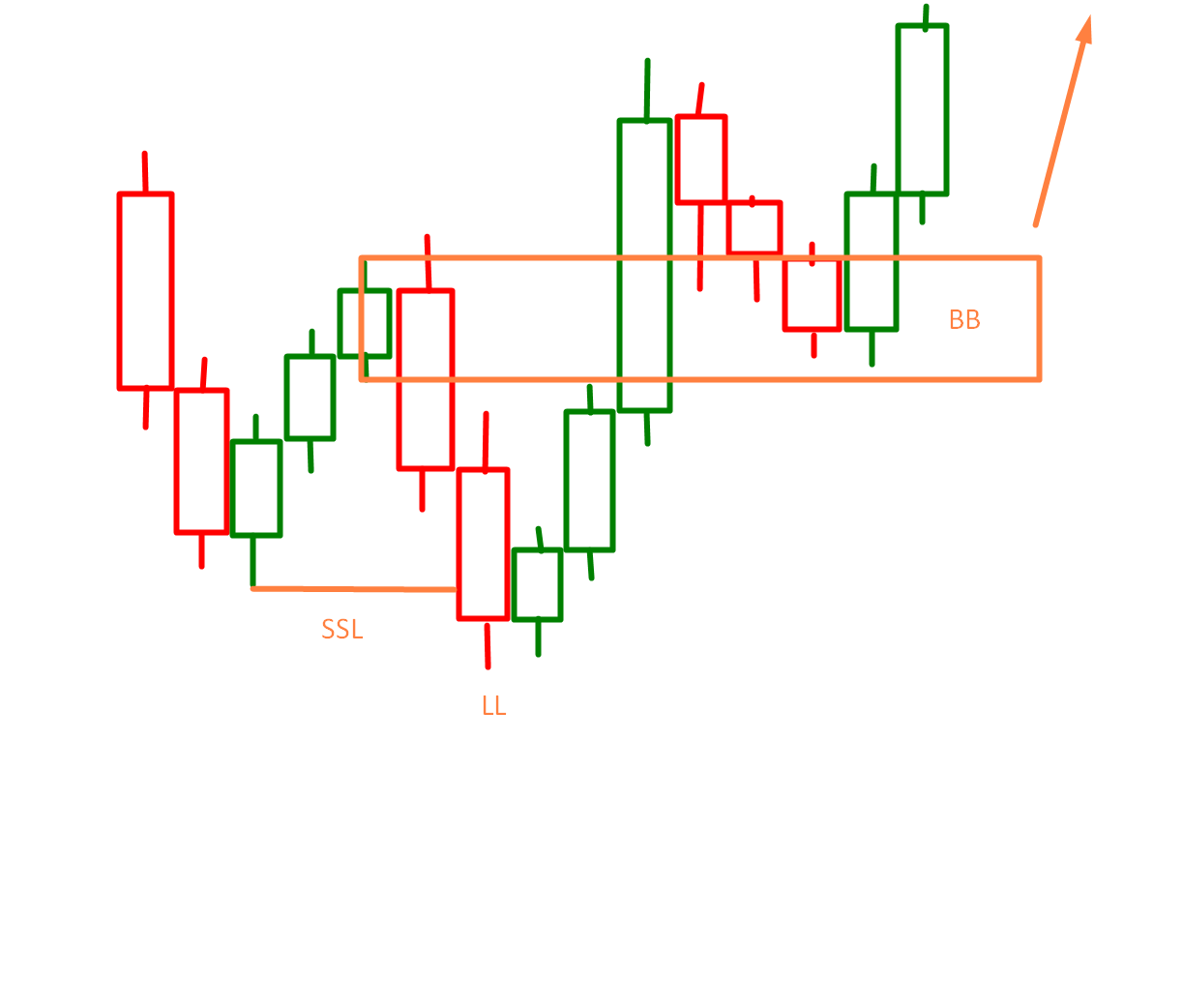

The downtrend begins with a break that leads to the creation of a Lower Low (LL). Subsequently, a Lower High (LH) forms, signaling the continuation of the downtrend unless it’s a correction in the higher timeframes (HTF). To confirm a downtrend, you should observe the development of three structural elements. Once these three elements are established, it becomes reasonable to consider taking short positions from the resistance zone, particularly when the HTF suggests a preference for price reduction.

The trend is confirmed after the formation of three structural elements.

After forming 3 elements of the downtrend, you can consider shorting positions from the resistance zone, provided HTF prioritizes reducing prices.

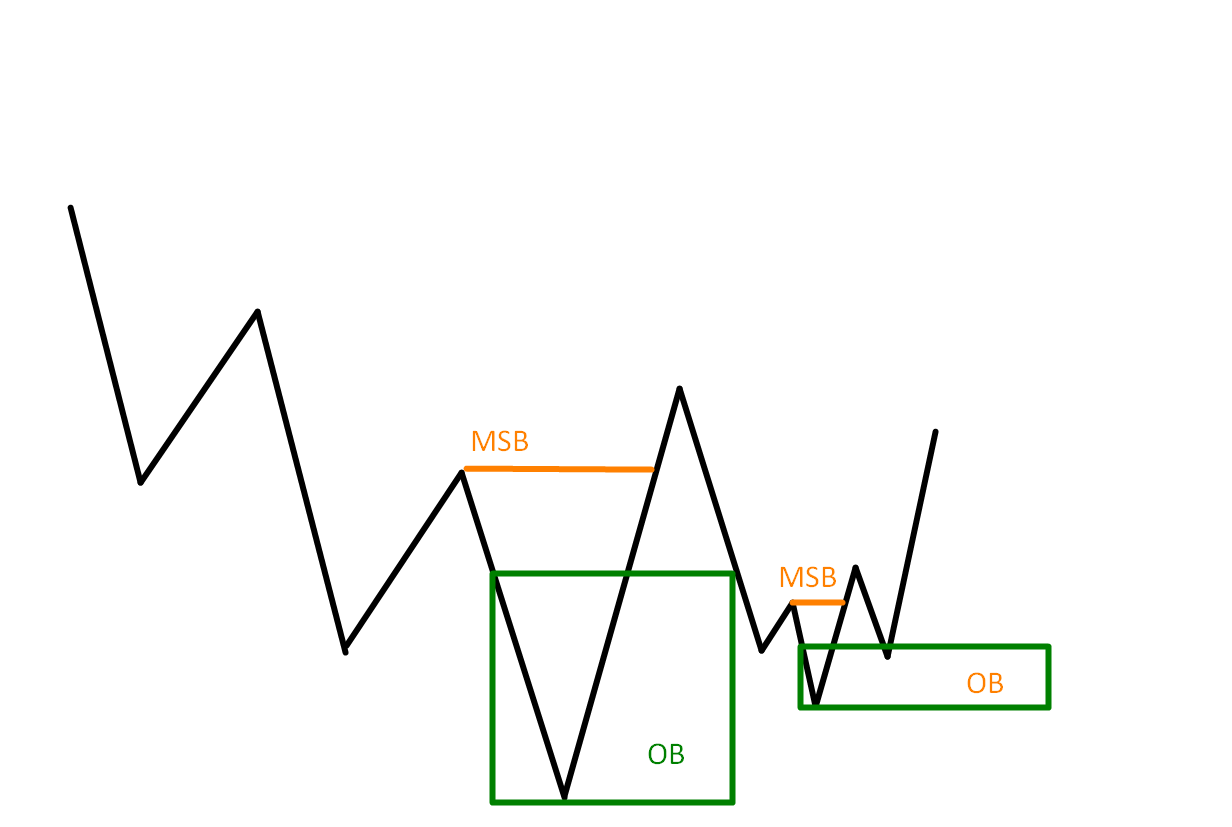

Another example and an additional, quite important criterion – candle breakaway – trade above the broken structure, denoted – MSB.

The place from which the impulse that broke the structure – 3 occurred is the support of the new trend.

The designations you may encounter on the net:

BOS = break of structure

MSB = Market Structure Break

CHoCH = Change of Character

Types of breakdown

-

- Strong breakdown – strong MSB

-

- Weak breakdown – weak MSB

-

- Entry into a trade on the LTF

False breakdown of the structure

A false break is formed and usually occurs on an HTF correction but on a smaller structure than the one on which the correction takes place. The price always seeks to update the local liquidity, so false signals occur.

That is, we see that there is a downtrend, there is an LL, and the LH is formed, during the formation of which we see a local ascending structure, which breaks and becomes descending again, but at the same time, there is still a correction on the HTF and further the LH is updated, which breaks the local trend again. This is how a false breakout of the structure is formed.

Types of structures

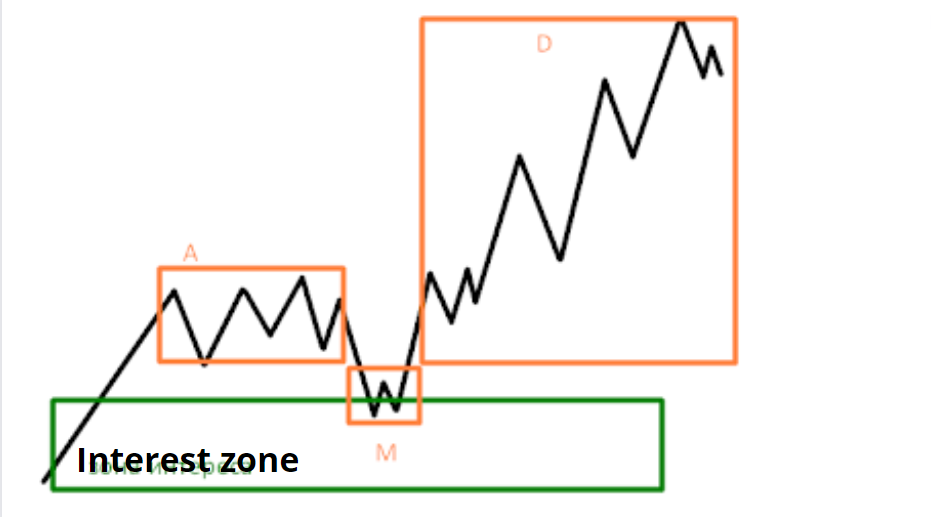

Understanding market structures is essential for traders, providing valuable insights into price movements and trends.

Swing Structure: These are significant structural elements formed in the direction of the prevailing price trend.

Internal Structure: Internal structures are divided into substructures and minor structures. Substructures (depicted in blue) develop inside the swing structure, representing counter-trend movements. Minor structures (also in blue) form within the swing structure, indicating sideways movements in alignment with the leading trend.

Substructure

Shown in blue, it builds inside the swing structure, forming a counter-trend – a movement in the opposite direction to the trend.

Minor structure

Depicted in blue, it builds inside the swing structure, forming a counter-trend – a movement to the side with the swing structure – in the direction of the leading trend.

Failure Swing – Failure Swing (SMS)

SMS – shift in market structure. The leading trend cannot reach HH and update it; consequently, the formation of a substructure begins.

Law of Effort (LoE)

The Law of Effort defines impulse and correction movement. The time to form an impulse should be less than the time for a correction. In this case, entering a position in the zone of interest on the correction will be safer. This is called momentum. Bearish and bullish momentum.

Fibonacci

Fibo levels are used to determine retracement targets and post-retracement movement targets.

The use of levels works in a trending movement with a good degree of retracement. When a directional movement is formed, the Fibo correction levels determine the premium zone to enter a position to continue the trend movement.

For the correct use of the tool, it is necessary to find a swing high and a swing low.

Example of an uptrend:

The grid is stretched from HL to HH (bottom to top). And if there was a break of the downtrend, then from LL to HH.

Example of a downtrend:

The grid is stretched from LH to LL (bottom to top). And if there was a break of the downtrend, then from HH to LL

Grid levels:

0.5 – fair market price

0.618, 0.705, 0.79 – zone OTE (optimal trader entry)

Smart money, as smart capital, never trades in unprofitable ranges, choosing OTE as the zone to dial in a position.

The OTE zone is called a discount market on an upward movement and a premium market on a downward movement.

Opening positions in these ranges are as safe as possible, and the RR ratio is always small due to the close location of the stop order.

Risk management

The most important stage in trading is working out a trading plan, entering a position, and following the plan. If the table has triggered – the calculation is incorrect, the set-up is irrelevant, the level is broken, or any of the reasons – it is obligatory to close the position and calculate a new entry.

The stop level should be calculated at the same time as the calculation of the opening price of the position.

-

- It is recommended to expose risk on the transaction in 1%.

-

- The position volume depends on the stop order calculation with a risk of 1% of the deposit.

-

- The risk-to-profit ratio should not be less than 1 to 3.

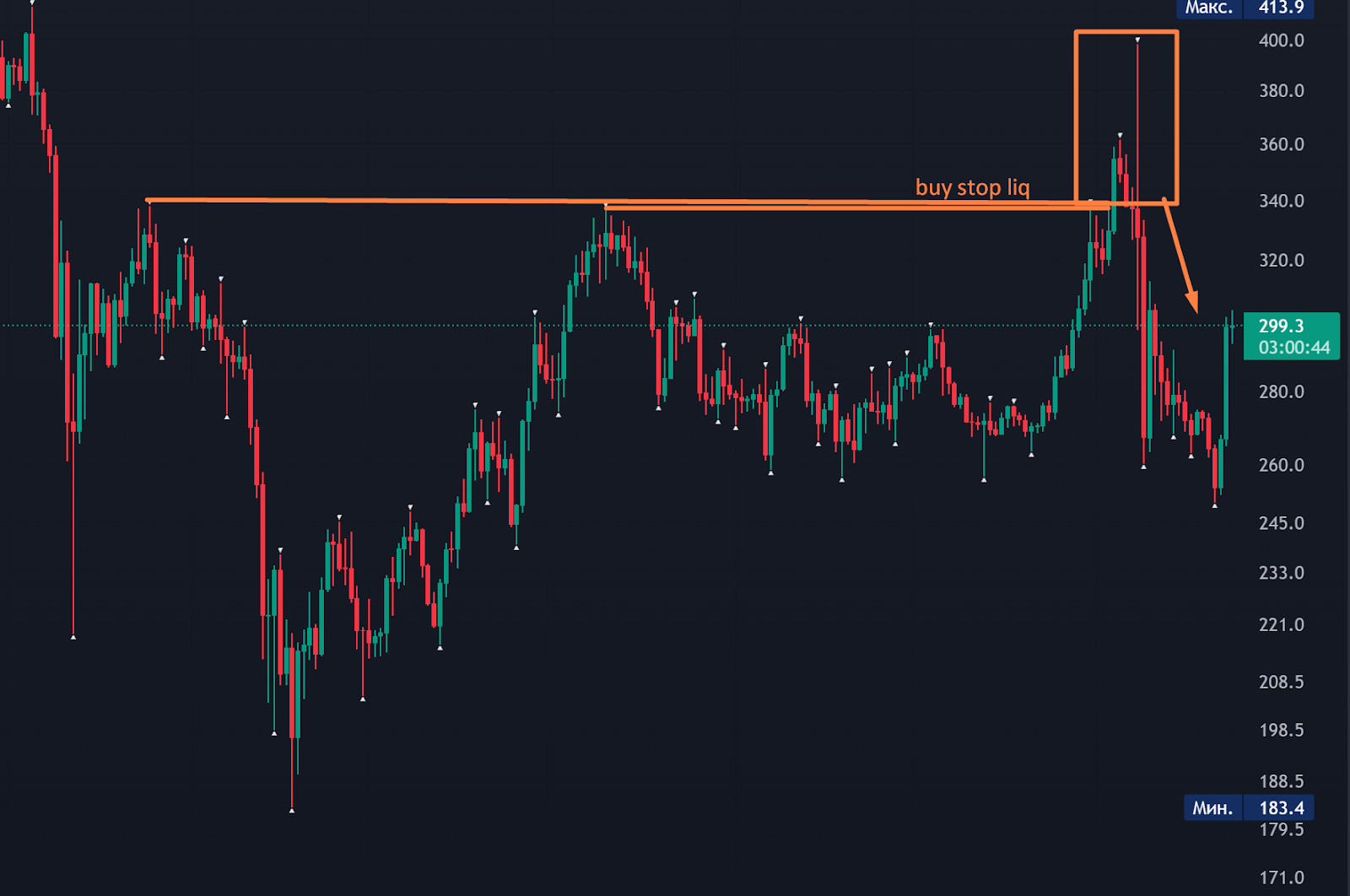

Liquidity

Liquidity is the open interest of market participants; in other words, all limit orders to sell and buy.

Smart capital constantly searches for liquidity to fill its planned large positions. Such accumulations are located at the breakdown points of the ranges; the longer the range, the greater the number of orders.

Buy stops Liquidity(BSL) & Sell stops Liquidity(SSL). These orders are stop orders for opening a position in the movement direction.

An example of liquidity formation is purchase and sale.

An example of liquidity withdrawal and range return and the beginning of a downward movement for smart capital.

How to search for liquidity collection sites

This requires swing highs and lows; behind each peak, liquidity is collected.

There are also equal highs behind which the maximum volumes are accumulated. Many traders consider such formations to be strong levels behind which they place their stop orders. Such extrema can be on approximately the same values; they do not necessarily have to be the exact price line, and such definitions as double top, triple top, and other patterns with several extrema in the same zone are suitable here.

Smart money creates these “levels” to form TAs and for traders to place their stop orders at the desired levels.

Equal highs, as the strongest shaping, will act as a magnet for price.

Equal highs, as the strongest formatting, will act as a magnet for price.

Below is the situation; under the Probit of the second TF, we consider the position in short, and as we see – the price has broken through the visible “level,” where the traders’ stops were, and the decisions to buy were made. Having gained liquidity, the price continued to fall.

In these zones, it is necessary to search for patterns: “M”, “TTS”, “TDP”.

Also, accumulation of liquidity occurs behind the extremes of candlesticks, on the removal of which, it is also necessary to search for a pattern on the continuation of the main trend.

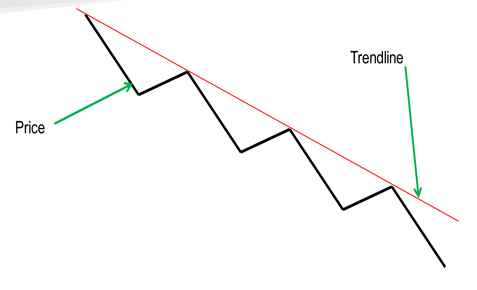

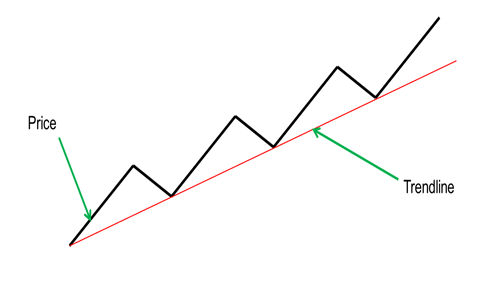

The liquidity set is the trend line.

The trend line is formed by the directional movement of the price, with retests to the order blocks and movements to fill imbalances. Thus, a contend motion is obtained, resulting in a volume of liquidity, which will later be used to accelerate growth or decline in value.

For example 3 peaks – trending, liquidity with which the downward movement began.

Another example. The price will only stop at the imbalance filling price:

In this example, after the upside movement, the price accumulated liquidity by moving in a downward range until it reached the discontinuity market

The trend line, as a frequently used tool in retail trading, is an indicator for opening trend-following positions:

At such times, smart capital will form a buy position and use the liquidity of buy stop orders for an impulse move upwards.

As a rule, the greater volume of liquidity is on the second LH, from which the trend line is formed.

Such formation is acceptable to consider only when approaching the zone of interest:

Zone of interest: OB, FVG,OTE.

At these moments in the small TF, you can see the formation of reversal patterns, such as W, TTS, and TDP.

Imbalance

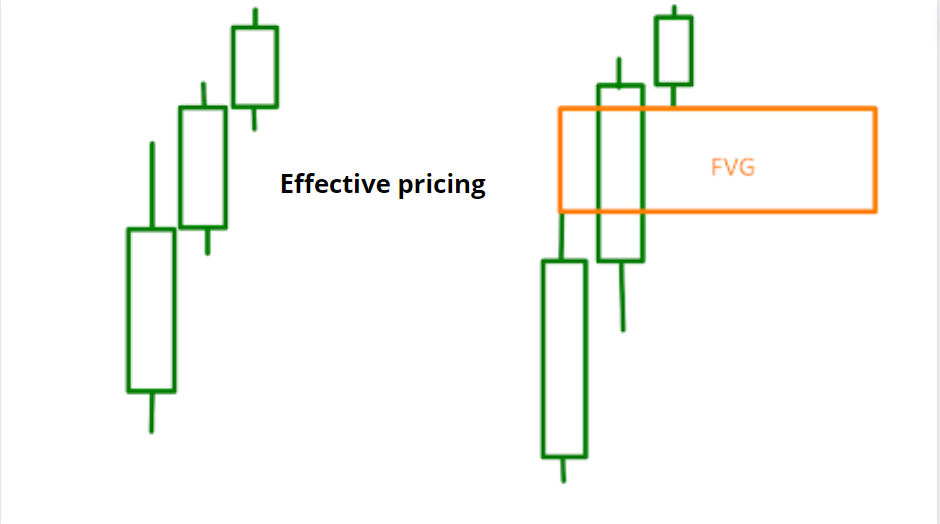

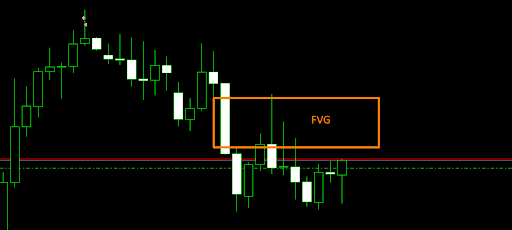

FVG – fair value gap – is a range in price delivery where only one party has bid liquidity, and the other has bid inefficiently.

The algorithm that ensures efficient market operation is set to fill the balance and pro-trade this range. Such a location acts as a magnet for price.

A bullish imbalance has liquidity to buy only, and a bearish imbalance has liquidity to sell only.

Imbalance can be used as an independent instrument for entering a position. According to statistics, Price fills 50% most often, rarely 100%, and combined with additional tools such as order block, breaker block, and mitigating block; the performance efficiency will be higher.

The use of imbalance is most effective at the moment of liquidity withdrawal from one of the sides, which is accompanied by impulse and formation of FVG. After a deceleration, the price usually tests and either partially or fills the imbalance, after which it continues to fall further.

Example. The price was moving in a downward direction, after which there was a stop hunt to buy liquidity, breaking of the structure, movement to the resistance area, retest, and partial filling of the bullish imbalance, after which the continuation of the upward movement.

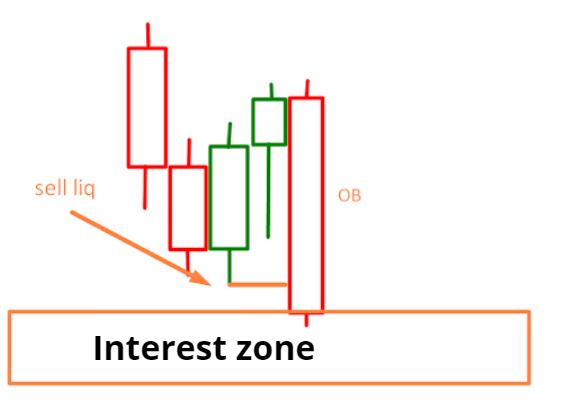

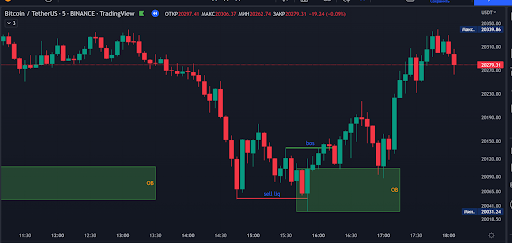

Order Block – OB

An Order Block (OB) is a crucial concept in trading that signifies a specific price zone where smart capital has executed significant buy or sell orders. When the price approaches this zone, it often triggers a noticeable reaction, causing the price to reverse its direction. These blocks can serve as key support or resistance levels and play a vital role in technical analysis strategies.

Smart capital initiates a wave of sales, activates stop orders, and sells stop orders, i.e., takes away open interest, thereby filling the largest volume in its orders to accumulate the long position.

Absorption of the lowest candle, which removes liquidity to sell – confirms the order block.

If the formation of the OB occurred at the support/resistance area, it increases the significance and the probability of the price reversal from this level.

After the absorption of the order block, the imbalance formation is expected – the rapid price movement, breaking the downward structure, which shows us the intention of the big player to lead the price higher. After the retest of the OB, with the filling of the FVG, the price will start to climb higher with an even greater probability.

The return to the OB occurs after the structure is broken.

The best order blocks get a reaction from the very beginning, but there can also be a price decline inside the OB, to accumulate the position even more. But as a rule, smart equity locks a losing short position after the price returns to the OB, which leads to an immediate price reaction from that point, reinforcing the buying.

To enter a position, the certain order block on the senior TF is used, and then descending on younger, it is possible to find a more exact place for an entrance, relying on local formations.

The stop-loss is placed under the extremum from which the order block was formed.

When determining, be sure to take into account the shadows of the candles.

Formation Criteria:

-

- Liquidity withdrawal.

-

- Absorption

Additional Criteria:

-

- Test support/resistance zone

-

- Imbalance

-

- Structure breakdown

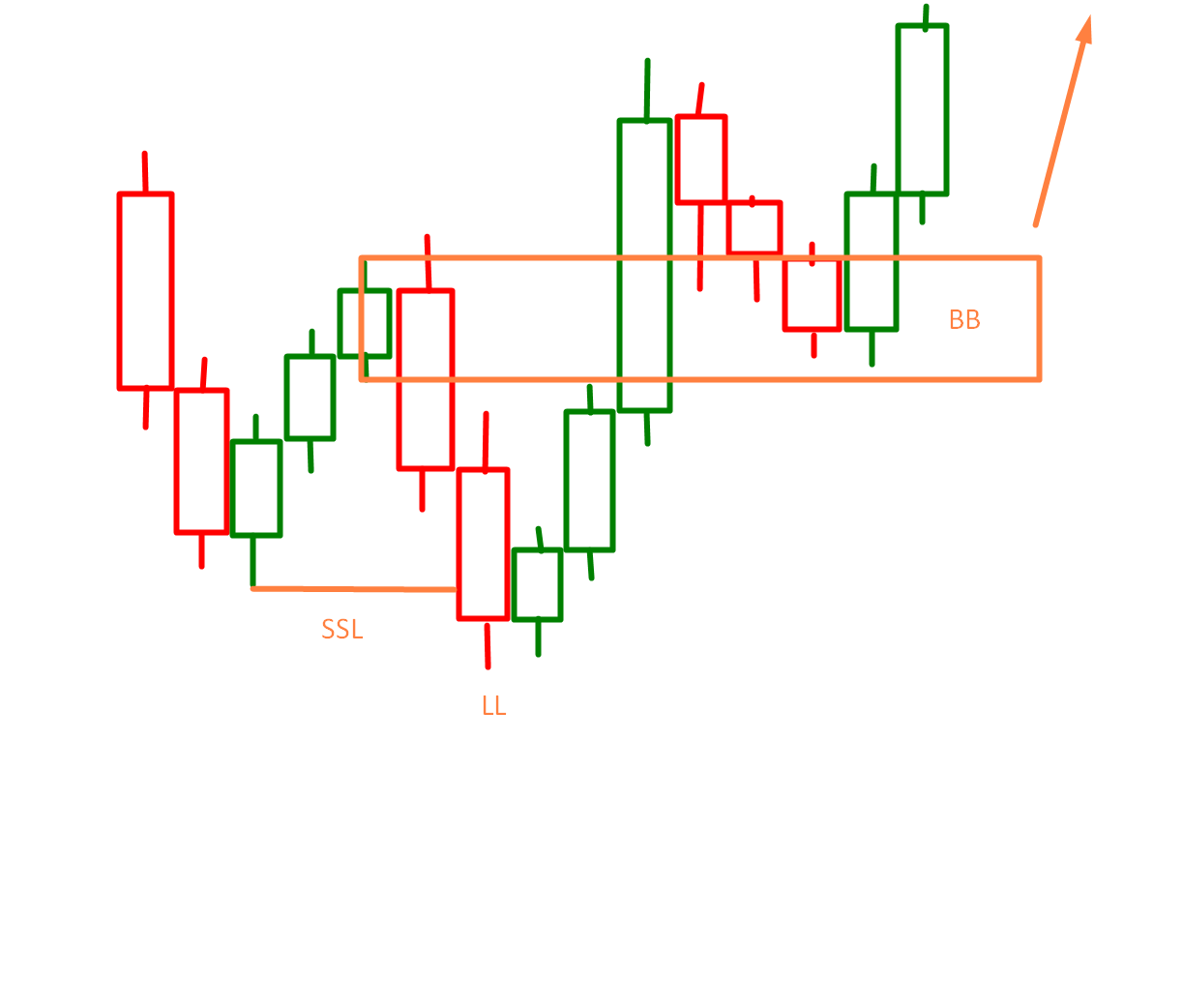

Breaker Block

This is an impulse block order after forming a new structural element HH or LL.

Before forming, the price removes liquidity and forms a new structural element.

Breaker (denoted together with the shadows), when broken, acts as a support zone, from which the price continues the movement started by the impulse.

When considering a BB entry, a stop loss should be placed behind the last structural element of a broken trend.

Mitigating block

A mitigating block is an impulsively broken high or low after the formation of the LH or HL. It can be used as a reversal pattern and a trend continuation pattern.

When opening positions, a stop loss can be placed over the border of the block, thus obtaining a high risk-to-profit ratio. However, this way, the stop is considered aggressive. Placing the stop behind the lead is the optimal solution, and the RR will be low.

Candle Shadows

The formation of a future swing can happen with a short-term update of the maximum or minimum; in this case, the formation of the order block will not happen since the exit will be made only by a hairpin. In this case, the work logic will be the same as with the order block, but the reference point will not be the whole candle but its shadow.

Formation criteria:

-

- Liquidity withdrawal.

-

- Closure below the updated maximum or above the minimum

-

- At the same time, finding a formation near a support zone increases the positive outcome for the formation

-

- Breaking of the structure is also an additional signal to intensify the formation

When entering a trade, a stop loss is placed behind the shadow of a candlestick that forms a high or low.

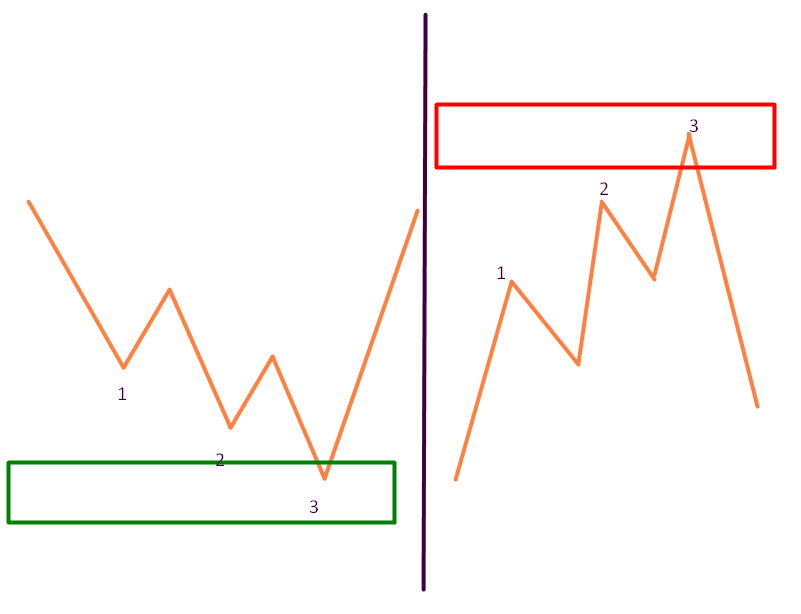

Three Drive Pattern (TDP)

The pattern consists of three ascending highs or lows and is a reversal pattern.

This pattern is formed because the market maker uses the liquidity of stop orders behind the local minimums as the volume of the set of his position. At the same time, sell stops are formed on the opposite side, which will provide impulse growth of the asset after accumulating the required position volume.

Entry into the position can be made after the third minimum has been formed. The stop order is placed under the zone of support or resistance.

As a rule, forming the third minimum forms a block order, the retest of which can strengthen the position in the direction of the future movement.

It is important to understand that just the formation of such a pattern is not a signal to enter the trade. It is necessary to have zones of interest in the place of pattern formation.

The most frequent formation of a false TDP occurs after an impulse, after which the price returns to fill the imbalance but continues downward movement.

An example of the formation of a reversal pattern.

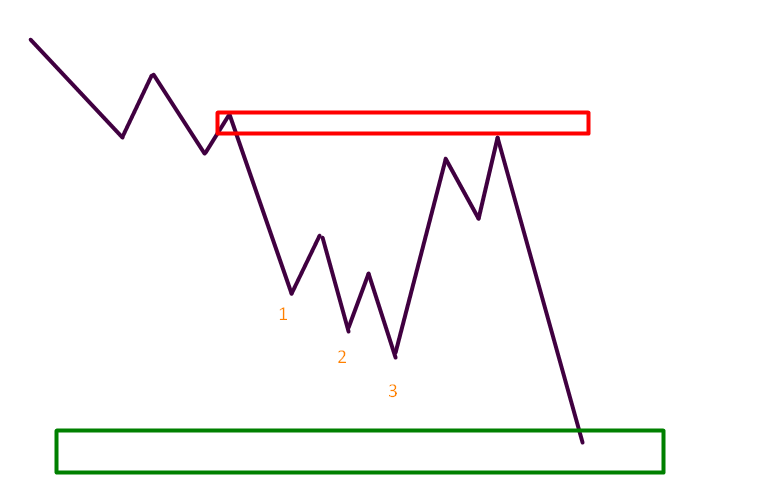

Three Tap Setup

The pattern of three touches is also a reversal pattern consisting of three movements.

Formation criteria:

-

- Presence of a zone of interest – support or resistance

-

- Formation of a short-term extremum, followed by updating a previously formed high or low

-

- Price return and break of the structure

-

- Retracement to the order block, to the zone of interest of local structures – the beginning of an opposite movement

It is safest to enter the trade on the third peak of the pattern; the stop loss is set below peak #2.

Senior timeframes

Opening HFT candlesticks determines the most profitable zones to enter a position.

These zones act as an additional decision factor.

How to use the Smart Money concept?

You gain a competitive edge in the cryptocurrency markets by understanding and effectively applying concepts such as Smart Money analysis, swing highs and lows, market structure, and various trading patterns.

You can identify critical support and resistance zones by utilizing tools like Order Blocks, Breaker Blocks, Mitigation Blocks, and Fair Value Gaps. Combine this with the power of Fibonacci retracement levels and awareness of liquidity accumulation sites, and you can pinpoint optimal entry and exit points for your trades.

Moreover, recognizing the influence of senior timeframes, trading sessions, and the Power of Three (accumulation, manipulation, and distribution cycles) empowers you to make well-informed decisions in the ever-changing crypto landscape.

As a trader, it is imperative to incorporate proper risk management strategies, including setting stop-loss orders and adhering to a disciplined money management approach. By following these guidelines, maintaining a sharp analytical eye, and continuously honing your trading skills, you can confidently navigate the cryptocurrency markets and increase your profitability over time.

FAQ

What is the best trading strategy?

The best trading strategy depends on capital, risk tolerance, and market conditions. There is no one-size-fits-all strategy. Tailoring your approach to your unique circumstances and continuously learning and adapting to the markets is essential.

What is liquidity in trading, and why is it important?

Liquidity represents the total volume of buy and sell orders in the market. Smart Money often looks for liquidity to execute large trades. Traders can identify liquidity zones to anticipate price movements and market reversals.

How do traders use Order Blocks and Breaker Blocks for trading?

Order Blocks indicate zones where institutional players have executed significant orders, acting as support or resistance. Breaker Blocks are formed after a new high or low and act as support when broken. Traders use these blocks to spot potential entry points and set stop-loss orders.

No responses yet