If you are interested in stock markets and considering buying stocks, you have probably heard about other assets like Bonds. Bonds are essentially loans that you give to a company or government in exchange for regular interest payments.

I have worked in the US stock market before and know this field well. I already considered particular stocks and trading strategies, but now I would like to discuss protection assets like US bonds.

Government bonds, in particular, are considered one of the safest investments because they are backed by the government’s ability to tax its citizens. This means that the likelihood of default is very low, making them a popular choice for conservative investors looking for a stable source of income. Government bonds also tend to have lower returns compared to stocks, but they are a good way to diversify your investment portfolio and reduce overall risk. If you are looking for a low-risk investment option, government bonds may be a good choice for you.

In this article, we will explore the key features of government bonds and why they are a popular choice for conservative investors.

When you should buy bonds

When considering when to buy government bonds, it is important to consider your financial goals and risk tolerance. Government bonds are typically seen as a long-term investment, so if you are looking for a quick return, they may not be the best option for you. However, if you are seeking a stable source of income and are willing to hold onto your investment for a number of years, government bonds can be a great choice.

Another factor to consider is the current interest rate environment. When interest rates are low, the returns on government bonds may also be lower. On the other hand, when interest rates are high, government bonds can offer more attractive returns. It is also essential to remember that bond prices can fluctuate based on changes in interest rates, so it is important to be aware of these potential risks.

Government bonds can be a valuable addition to your investment portfolio, providing stability and diversification. By understanding their key features and carefully considering your financial situation, you can make an informed decision about whether or not to invest in them.

Types of Bonds (bond information)

There are several types of government bonds to consider when looking to invest. Some common types include Treasury bonds, Treasury notes, and Treasury bills. Treasury bonds typically have longer maturities, ranging from 10 to 30 years, and offer higher interest rates. Treasury notes have shorter maturities, usually between 2 to 10 years, and provide a lower interest rate. Treasury bills, on the other hand, have the shortest maturity of less than one year and are sold at a discount to their face value.

In addition to these types of government bonds, there are also municipal bonds and corporate bonds to consider. Municipal bonds are issued by state and local governments to fund public projects, and they are often exempt from federal taxes. Corporate bonds, on the other hand, are issued by companies to raise capital, and they typically offer higher interest rates than government bonds but come with a higher level of risk.

Here’s a detailed comparison table for different types of bonds:

| Type of Bond | Issuer | Maturity Range | Interest Rate | Tax Treatment | Risk Level |

|---|---|---|---|---|---|

| Treasury Bonds | Federal Government | 10 to 30 years | Higher | Federal taxable | Low |

| Treasury Notes | Federal Government | 2 to 10 years | Moderate | Federal taxable | Low |

| Treasury Bills | Federal Government | Less than 1 year | Sold at discount | Federal taxable | Low |

| Municipal Bonds | State and Local Governments | Varies | Variable, often lower | Often tax-exempt | Moderate |

| Corporate Bonds | Companies | Varies | Higher than government bonds | Taxable | Higher |

| Savings Bonds | Federal Government | 1 to 30 years | Fixed or inflation-adjusted | Federal taxable, state and local tax-exempt | Low |

| Agency Bonds | Government-Sponsored Enterprises (GSEs) | Varies | Moderate | Federal taxable | Low to Moderate |

| Foreign Bonds | Foreign Governments or Companies | Varies | Variable | Taxable, depending on the country | Variable |

| Convertible Bonds | Companies | Varies | No periodic interest, sold at a deep discount | Taxable | Moderate |

| Zero-Coupon Bonds | Various | Long-term | No periodic interest, sold at deep discount | Taxable upon maturity | Moderate to High |

Key Points to Consider Choosing Bonds:

- Investment Goals: Determine if you seek long-term growth, short-term gains, or tax advantages.

- Risk Tolerance: Understand your comfort with the potential for loss versus the stability of returns.

- Time Horizon: Align bond maturity with your investment timeframe.

Building a diversified bond portfolio can help manage risk and stabilize returns. Consult with a financial advisor to tailor your bond investments to your specific financial situation and goals.

Why To Buy Government Bonds

Most rating agencies, such as Bloomberg, Kroll Bond Rating Agency (KBRA), DBRS Morningstar, and A.M. Best, recommend government bonds. Bonds are a popular investment choice for many individuals due to their relatively low risk compared to stocks. They offer a fixed income stream over a specified period of time, making them a stable option for those looking to preserve capital or generate regular income.

When To Buy US Government Bonds

When considering when to buy government bonds, it is important to take into account your financial goals and risk tolerance. Government bonds are typically seen as a long-term investment, so if you are looking for a quick return, they may not be the best option for you. However, if you are seeking a stable source of income and are willing to hold onto your investment for a number of years, government bonds can be a great choice.

Another factor to consider is the current interest rate environment. When interest rates are low, the returns on government bonds may also be lower. On the other hand, when interest rates are high, government bonds can offer more attractive returns. It is also important to keep in mind that bond prices can fluctuate based on changes in interest rates, so it is important to be aware of these potential risks.

Overall, government bonds can be a valuable addition to your investment portfolio, providing stability and diversification. By understanding the key features of government bonds and carefully considering your own financial situation, you can make an informed decision on whether or not to invest in them.

Benefits of Investing in Government Bonds:

- Low Risk: Government bonds are considered one of the safest investments because they are backed by the full faith and credit of the issuing government. Compared to corporate bonds or stocks, the risk of default is minimal.

- Fixed Income: They provide regular interest payments, making them ideal for investors seeking a predictable income stream. This is particularly beneficial for retirees or those needing steady cash flow.

- Capital Preservation: Government bonds are a reliable option for investors looking to preserve their capital. They ensure the return of the principal amount at maturity, barring any government default.

- Portfolio Diversification: Bonds have a negative correlation with the stock market and a 50% correlation with gold, making them a valuable addition to a well-rounded investment portfolio. This correlation helps in balancing the overall portfolio risk and enhances stability.

- Protective Asset: Government bonds are often used as a protective asset in investment portfolios. During periods of economic uncertainty or market volatility, they can provide a safe haven, preserving capital and providing stability.

- Inflation Protection: Some government bonds, like Treasury Inflation-Protected Securities (TIPS), are designed to protect against inflation. The principal value of TIPS increases with inflation, providing a hedge against rising prices.

- Tax Advantages: Interest earned on some government bonds may be exempt from state and local taxes, offering tax benefits to investors.

- Liquidity: Government bonds are highly liquid, meaning they can be easily bought and sold in the market. This makes them a flexible investment choice for those who might need to access their funds quickly.

Recommendations by Rating Agencies:

Rating agencies such as Moody’s, Standard & Poor’s, and Fitch often recommend government bonds for their safety and reliability. These agencies assess the creditworthiness of bond issuers, and government bonds typically receive high ratings due to the low risk of default.

Investing in bonds is a strategic way to diversify and stabilize an investment portfolio. When compared to corporate bonds, there are several reasons why government bonds are generally considered a better option for many investors.

Safety and Risk

Lower Risk: Government bonds are considered one of the safest investments. They are backed by the full faith and credit of the issuing government, significantly reducing the risk of default. This makes them a secure option, especially during economic downturns or periods of market volatility.

Creditworthiness: Rating agencies such as Moody’s, Standard & Poor’s, and Fitch typically give government bonds high credit ratings due to the low risk of default. In contrast, corporate bonds carry a higher level of risk because their repayment depends on the issuing company’s financial health. If the company faces financial difficulties, it could default on its bonds, leading to potential losses for investors.

Income and Returns

Predictable Income: Government bonds provide a reliable and predictable fixed income stream over a specified period. This can be particularly beneficial for retirees or investors seeking steady cash flow.

Inflation Protection: Certain government bonds, like Treasury Inflation-Protected Securities (TIPS), are designed to protect against inflation. Their principal value increases with inflation, preserving the purchasing power of your investment.

Tax Benefits

Tax Advantages: Interest earned on some government bonds may be exempt from state and local taxes, providing an additional tax benefit that is not typically available with corporate bonds. Municipal bonds, for example, are often exempt from federal taxes and, in some cases, state and local taxes as well.

Market Stability

Negative Correlation with Stocks: Government bonds often have a negative correlation with the stock market and a 50% correlation with gold. This means they tend to perform well when stocks are doing poorly, providing a hedge against market downturns and adding stability to an investment portfolio.

Liquidity: Government bonds are highly liquid, meaning they can be easily bought and sold in the market. This liquidity provides flexibility for investors who might need to access their funds quickly.

Comparison of Government with Corporate Bonds

Despite there are some different types of bonds, the main competitors are Corporate and Government Bonds. You should know that they have different risk tolerance, purposes, income rates, etc. Let’s dive deeper in their differences analysis.

Comparison Table: Government Bonds vs. Corporate Bonds

| Feature | Government Bonds | Corporate Bonds |

|---|---|---|

| Issuer | National Governments | Companies |

| Risk Level | Higher, dependent on the company’s financial health | Higher, dependent on company’s financial health |

| Interest Rates | Generally lower | Typically higher |

| Tax Benefits | Some offer tax exemptions (e.g., municipal bonds) | Generally taxable at federal and state levels |

| Liquidity | Highly liquid and easy to trade | Varies, influenced by issuer’s size and credit rating |

| Use Case | Ideal for conservative investors seeking stable income and capital preservation | Suitable for investors seeking higher returns and willing to take on more risk |

| Maturity Range | Short to long-term (1 to 30 years) | Varies, typically medium to long-term (1 to 30 years) |

| Credit Ratings | Usually high (AAA to AA) | Varies widely (AAA to junk status) |

| Market Sensitivity | Less sensitive to economic changes | More sensitive to economic changes |

| Inflation Protection | Some offer protection (e.g., TIPS) | Generally do not offer inflation protection |

Key Takeaways:

- Government Bonds: Safer, stable, and ideal for conservative investors. They offer lower returns but are backed by the government’s ability to tax, making them less risky. They can also provide tax benefits and are highly liquid.

- Corporate Bonds: Higher risk and potential for higher returns. They require careful assessment of the issuing company’s financial health. They are more suitable for investors willing to accept greater risk for the chance of higher yields. Tax benefits are generally not as favorable as government bonds.

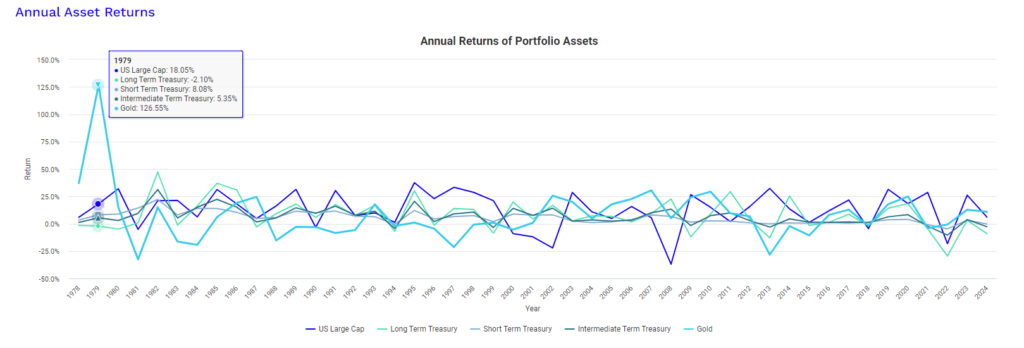

Correlation of Treasury Bond with Other Asset Classes

Government Bonds:

- Negative Correlation with the Stock Market: Government bonds often perform better or remain stable when the stock market declines. This negative correlation helps reduce overall portfolio risk during market downturns, providing a hedge against stock market volatility.

- 50% Correlation with Gold: This moderate correlation with gold adds another layer of diversification. Gold is traditionally seen as a safe-haven asset, especially during inflationary periods. Government bonds’ correlation with gold helps protect against inflation and adds stability to the portfolio.

Corporate Bonds:

- Tight Correlation with the Stock Market: Corporate bonds are essentially loans to companies, so their performance is closely tied to the issuing company’s financial health and, by extension, the stock market. When the stock market declines, corporate bonds often follow suit, increasing the overall risk of the investment portfolio.

Corporate bonds are issued by companies to raise capital for various purposes. While they typically offer higher interest rates than government bonds, they come with a higher level of risk. Investors should carefully assess the financial health of the issuing company before investing in corporate bonds.

Importance of Portfolio Diversification

Diversifying your bond portfolio with a mix of government and corporate bonds can help spread out risk and potentially increase overall returns. Government bonds can provide stability and safety, while corporate bonds can offer higher yields but with increased risk.

Risks of Government Bonds

While government bonds are generally considered safer investments compared to stocks and corporate bonds, they are not without risks. Understanding these risks is essential for making informed investment decisions.

1. Interest Rate Risk

Explanation: Interest rate risk refers to the risk that the value of bonds will decline due to rising interest rates. When interest rates increase, the price of existing bonds typically falls because newer bonds are issued with higher yields.

Impact: Investors holding long-term government bonds are more susceptible to interest rate risk compared to those holding short-term bonds. If investors need to sell a bond before it matures, they might incur a loss if interest rates have risen since the bond was purchased.

2. Inflation Risk

Explanation: Inflation risk, or purchasing power risk, is the danger that inflation will erode the purchasing power of the fixed interest payments from the bond.

Impact: If the inflation rate exceeds the bond’s yield, the real return on the bond becomes negative. This is particularly concerning for long-term bonds where inflation can significantly impact returns over time.

3. Credit Risk

Explanation: Although government bonds are generally seen as low-risk, there is still a potential risk of default, especially in countries with unstable economic or political conditions.

Impact: Bonds issued by stable governments (like U.S. Treasury bonds) have minimal credit risk, but those from emerging markets can have higher credit risk. A government default could result in the loss of both interest payments and the principal.

4. Liquidity Risk

Explanation: Liquidity risk is the risk that an investor might not be able to sell their bond easily without impacting its price.

Impact: While most government bonds are liquid, some less popular issues or bonds from smaller or less stable governments might not have as active a secondary market, making them harder to sell quickly.

5. Reinvestment Risk

Explanation: Reinvestment risk occurs when an investor has to reinvest the income or principal from a bond at a lower interest rate than the original bond.

Impact: This is particularly relevant for callable bonds, where the issuer might redeem the bond early if interest rates fall, forcing the investor to reinvest at lower rates.

6. Currency Risk

Explanation: Currency risk is the risk of loss from fluctuations in the exchange rate for investors purchasing foreign government bonds.

Impact: If the investor’s home currency strengthens against the foreign currency, the returns on the foreign bond could diminish when converted back to the home currency.

7. Political and Economic Risk

Explanation: Government bonds are subject to political and economic changes within the issuing country. Changes in government policy, economic instability, or geopolitical events can impact bond prices and yields.

Impact: Political instability or economic downturns in the issuing country can affect the government’s ability to meet its debt obligations, impacting bond prices.

Taxes in US Government Bonds

You should always be aware that you need to pay taxes in any country you reside in or invest in. Understanding the taxation aspects of your investments, including government bonds, is crucial for effective financial planning and compliance with tax laws. Government bonds are a popular investment choice due to their relatively low risk and predictable returns, but they come with specific tax implications that you must consider. Series I Savings Bonds:

- Issuer: U.S. Department of the Treasury.

- Purpose: Designed to protect against inflation.

- Interest: Combines a fixed rate and a semiannual inflation rate.

- Current Composite Rate (May 1, 2024, to October 31, 2024): 4.28%.

- Fixed Rate: 1.30%.

- Semiannualized Inflation Rate: 2.96% (measured by the Consumer Price Index for all Urban Consumers, or CPI-U).

- Maturity: Accrue interest until redeemed or final maturity at 30 years.

- Taxation:

- Federal Tax: Interest earned is taxable when redeemed.

- State and Local Tax: Interest is not taxable at the state or local level.

Series EE Savings Bonds:

- Issuer: U.S. Department of the Treasury.

- Interest:

- Current Fixed Rate (May 2024 to October 2024): 2.70%.

- Bonds issued since May 2005 earn a fixed rate for the first 20 years.

- After 20 years, the bonds will be worth at least twice their purchase price.

- Continue earning interest at the original fixed rate for an additional 10 years unless new terms are announced.

- Taxation:

- Federal Tax: Interest earned is taxable when redeemed.

Purchasing Savings Bonds with Tax Refunds:

- Option: During the 2024 tax filing season, taxpayers can purchase Series I Savings Bonds using part or all of their tax refund.

- Purchase Details:

- Increment: Bonds can be purchased in increments of $50.

- Maximum: Up to $5,000 per year.

- Redemption:

- Bonds can be redeemed for principal and accrued earnings after the first 12 months.

- If redeemed within the first 5 years, the most recent 3 months’ interest will be forfeited.

- No interest forfeiture after 5 years.

- Process: Use Form 8888, Allocation of Refund, to purchase savings bonds with a tax refund.

Government bonds, such as Series I and Series EE Savings Bonds, offer a secure investment option with specific tax advantages. Series I bonds protect against inflation, while Series EE bonds provide a guaranteed return over time. Both types are subject to federal tax upon redemption but are exempt from state and local taxes. Taxpayers also have the option to purchase Series I bonds with their tax refunds, providing a convenient way to invest. As always, consult with a tax professional or financial advisor to navigate the complexities of tax regulations and optimize your investment strategy.

How to Buy US Government Bonds

When it comes to purchasing government bonds in the United States, you have the option to buy them directly yourself or through a broker.

Let’s explore both approaches:

Buying Directly (Self-Purchase) for buying US Government Bonds:

Pros:

- Control: You have direct control over your investment decisions, including choosing the specific bonds you want to purchase.

- No Brokerage Fees: When you buy bonds directly from the U.S. Department of the Treasury (via TreasuryDirect), you avoid paying any brokerage fees or commissions.

- Simplicity: The process is straightforward, especially if you’re comfortable using online platforms.

Cons:

- Limited Support: You won’t have personalized advice from a broker or financial advisor.

- Learning Curve: If you’re new to bond investing, there might be a learning curve as you familiarize yourself with the process and terminology.

- Time Commitment: Managing your own bond portfolio requires time and attention.

Using a Broker for Buying US Government Bonds:

Pros:

- Diversification: Brokers can help you diversify your bond portfolio by recommending various bonds.

- Expertise: Brokers can provide expertise and guidance based on your financial goals and risk tolerance.

- Convenience: If you prefer a hands-off approach, a broker can handle the details for you.

Cons:

- Fees: Brokers typically charge fees or commissions for their services. These fees can vary.

- Potential Conflicts of Interest: Some brokers may prioritize certain bonds based on their own incentives.

- Loss of Control: You’re relying on someone else’s judgment.

My Recommendation:

- If you’re comfortable navigating the process and want to avoid fees, consider buying government bonds directly through TreasuryDirect.

- Working with a reputable broker might be a good choice if you prefer personalized advice and are willing to pay for it.

Remember that your decision should align with your financial goals, risk tolerance, and level of expertise. Always consult with a financial advisor to make an informed choice.

Conclusion

In conclusion, government bonds offer a secure investment option with specific tax advantages, such as protection against inflation and guaranteed returns. Understanding the risks associated with bonds, including liquidity risk, reinvestment risk, currency risk, and political and economic risk, is crucial for investors. Additionally, knowing the taxation aspects of investments in government bonds, like Series I and Series EE Savings Bonds, is essential for effective financial planning and compliance with tax laws.

When it comes to buying government bonds, investors have the choice of purchasing them directly or through a broker. Buying directly provides control, no brokerage fees, and simplicity while using a broker offers diversification, expertise, and convenience. Ultimately, the decision to buy government bonds directly or through a broker should align with individual financial goals, risk tolerance, and level of expertise. Consulting with a financial advisor can help investors make informed decisions tailored to their specific needs.

No responses yet